Regulatory Sandbox Guide

The Regulatory Sandbox is a framework established by the National Bank for testing innovative financial services and/or products in a controlled environment.

Main Advantages of the Regulatory Laboratory

• The opportunity to test in a real environment with real users;

• The ability to collaborate continuously with the regulator and conduct testing under its supervision to prevent flaws or violations in the final version of the product and/or service;

• The possibility to define new regulatory requirements or amend existing ones based on practical experience.

Criteria Applicants Must Meet to Participate in the Regulatory Laboratory

The applicant must, as assessed by the National Bank, utilize a financial technology that is new to the local market, and the proposed financial service and/or product must meet at least one of the following conditions:

- Increases the accessibility, efficiency, security, and/or quality of financial services and/or products;

- Improves the effectiveness of risk management by entities supervised by the National Bank;

- Provides significant additional benefits to consumers;

- Supports increased financial inclusion.

The financial service and/or product proposed by the applicant must either require the consent of the National Bank and/or create the need to amend the existing regulatory framework or define new regulatory requirements.

The applicant must have assessed the usefulness, functionality, and associated risks of the proposed financial service and/or product.

Registration in the Regulatory Laboratory

The applicant must contact the National Bank through the structural unit(s) responsible for supervising its activities and/or via the official email address.

The applicant must submit a completed application form to the National Bank, which must include:

- Justification of how the proposed financial service and/or product meets the criteria defined by the regulation;

- A clear indication of which rule, instruction, regulation, resolution, requirement, and/or guideline prevents the implementation of the proposed financial service and/or product.

Justification of how the applicant intends to conduct activities related to the innovative financial service and/or product, including:

- A description of expected outcomes, along with qualitative and quantitative performance indicators;

- Evidence of access to the necessary resources for testing the financial service and/or product in a controlled environment;

- If applicable, an assessment of money laundering and terrorism financing risks, along with a description of mitigation measures.

A strategy for transitioning from the test environment to the real market.

Exit plan for the use of the innovative financial service and/or product.

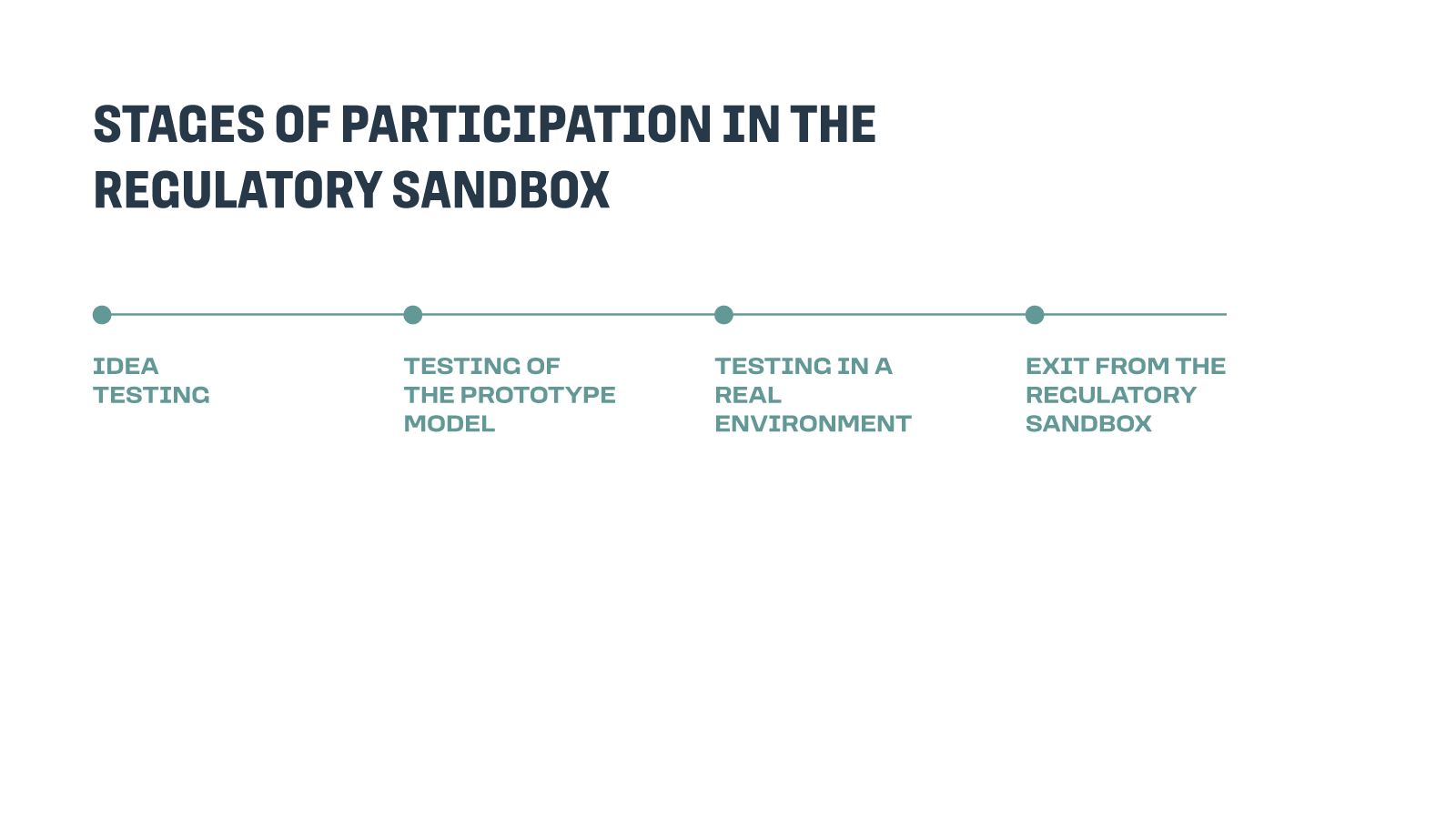

Stages of Participation

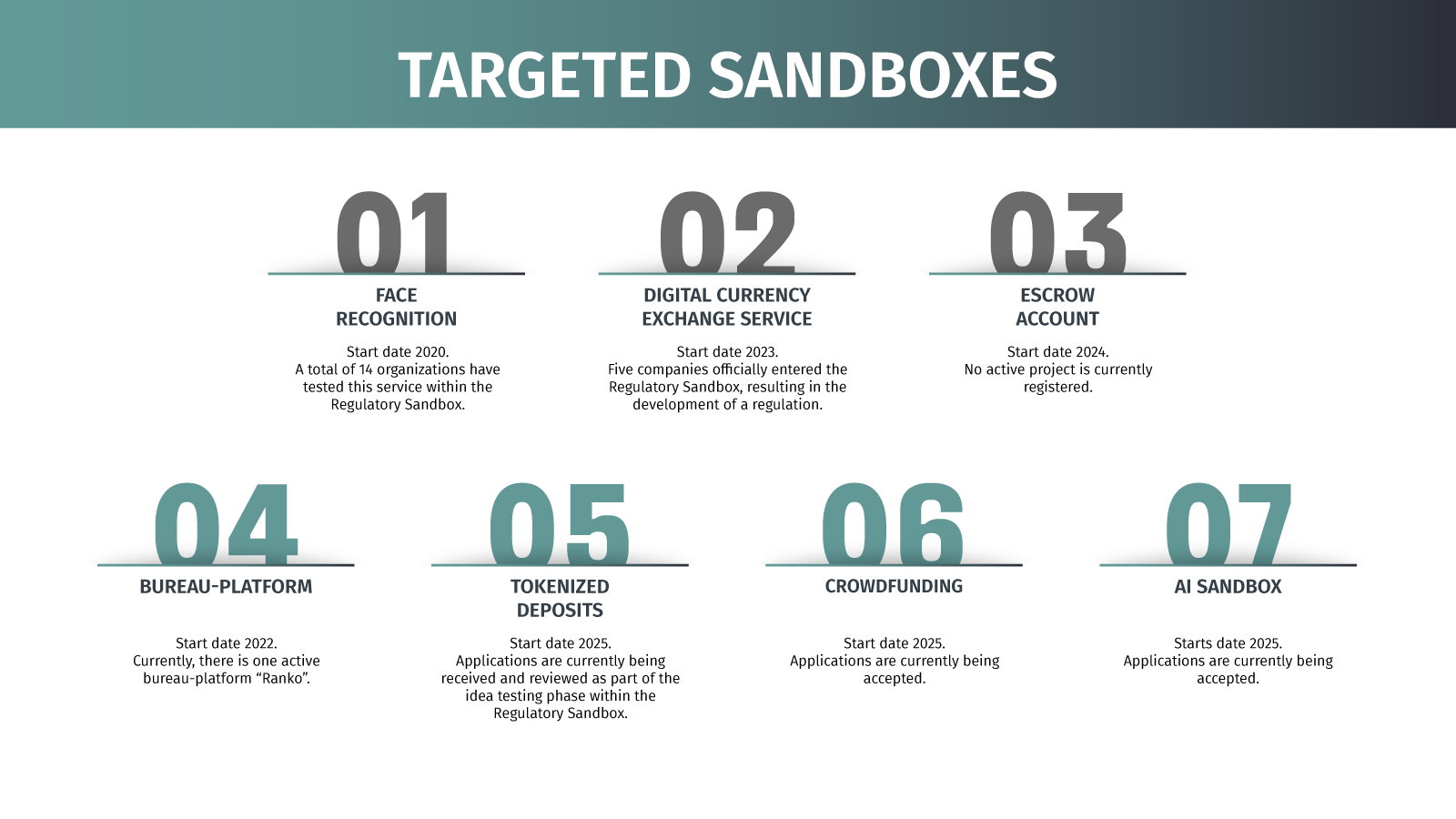

Target Sandboxes

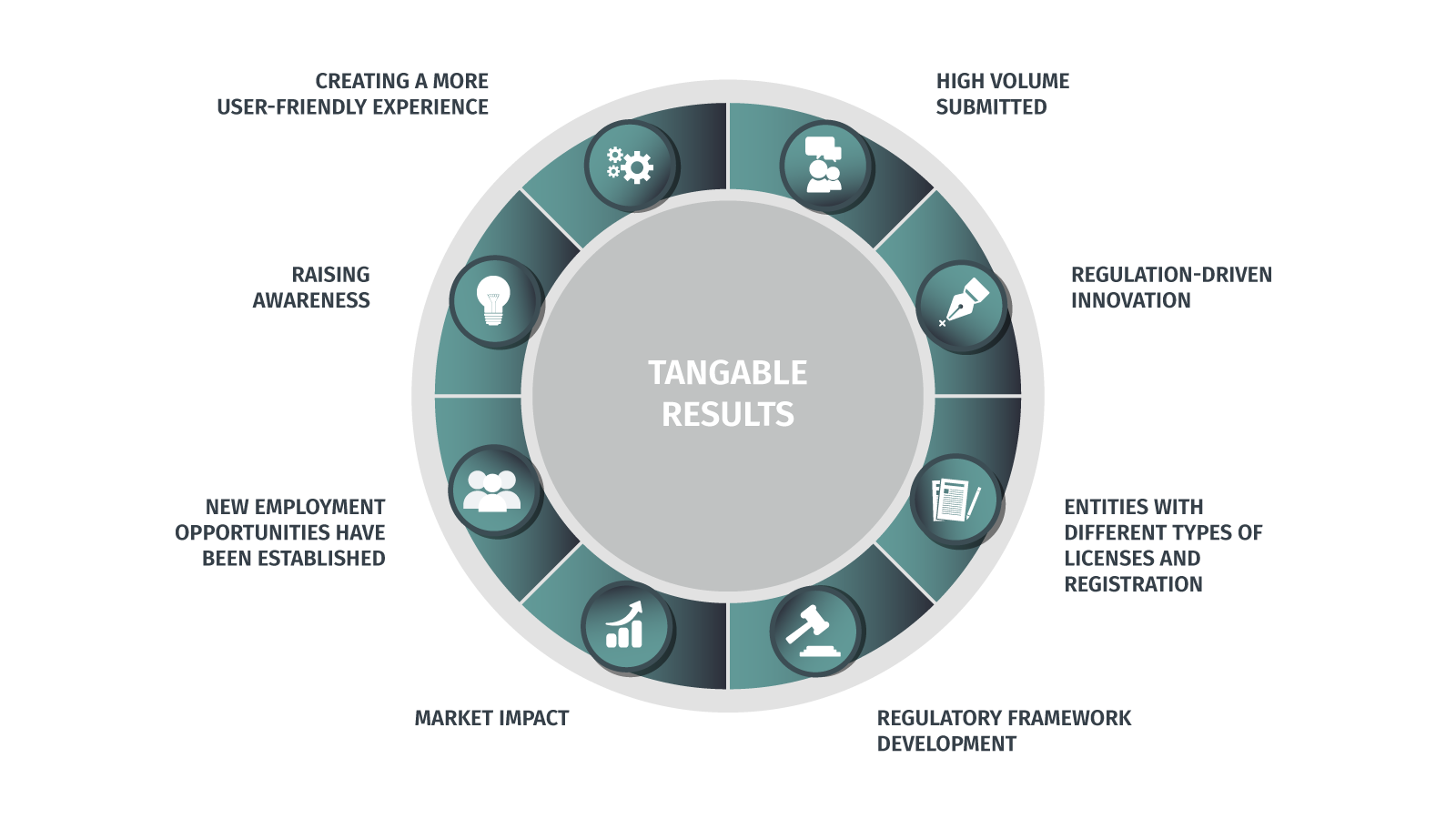

Tangable results

Contact

Please send us your questions via email at: InnovationOffice@nbg.gov.ge