Resolution Process

The National Bank of Georgia prepares resolution plans for systemically important commercial banks on an annual basis. It is through the plan that it does resolvability assessment and determines its resolution strategy through modeling.

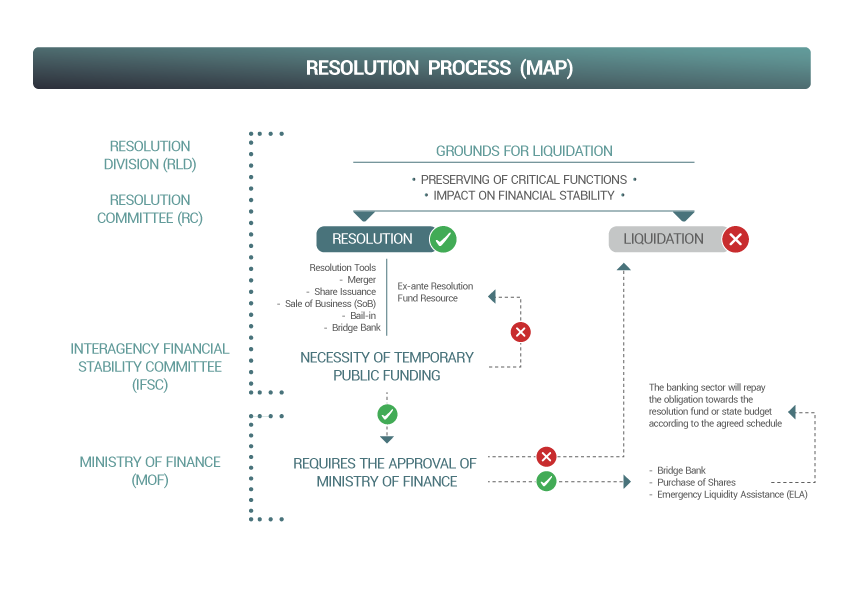

In case of a financial distress of bank, Failing or Likely to Fail (FOLTF) is assessed by the supervision and resolution functions of the National Bank. As the grounds of the resolution are met, the issue is filed to the Resolution Committee of the National Bank for review and decision. The Committee takes into account factors such as the financial performance of the bank, the critical importance of its economic functions for the financial system stability and outlook, and considers the introduction of a resolution regime.

Before the resolution regime comes into force, the elements of the available resolution plan and the latest data are analyzed, and the need for deviation from the plan is determined. A special manager of the resolution regime may be appointed and various effective actions may be taken.

The resolution process, depending on the complexity of the strategy and implementation, may require the involvement of the Interagency Financial Stability Committee (IFSC) as a platform for cooperation in overcoming the challenges of the crisis.