Financial Stability Committee’s Decision

Georgian Financial System remains resilient and continues smooth lending to the economy even in times of the pandemic. During 2021, asset quality, profitability, capital and liquidity ratios of the banking sector improved, which allowed banks to recover buffers, released in the beginning of the pandemic, before the date set by the NBG. The significant share of banks have already recovered released buffers, while the banking sector will return to the pre-crisis capital adequacy ratio in 2022.

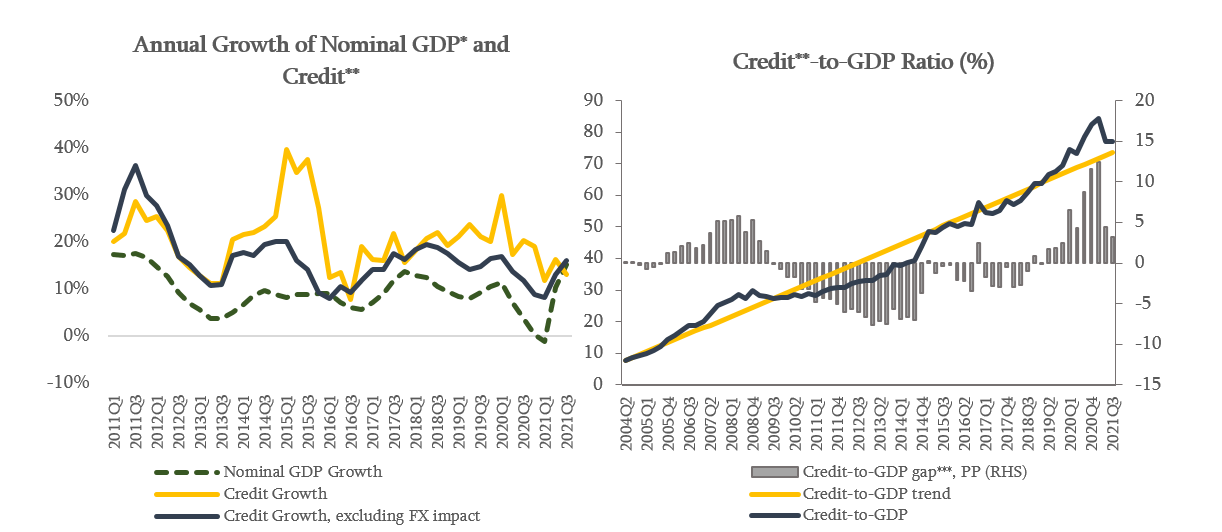

The Financial Stability Committee of the NBG decided to leave the countercyclical capital buffer unchanged, at 0%. The annual growth rate of credit portfolio in October 2021, excluding the exchange rate effect, amounted to 16.2%, which is mainly driven by the growth of business loans and from the currency perspective, by the lending in the national currency. However, increasing dynamics of foreign currency lending is noteworthy. The Credit-to-GDP ratio still exceeds its long run trend, however, the credit-to-gdp gap decreased significantly compared to the beginning of the year, which reflects the impact of high economic growth and exchange rate appreciation. It should be noted that, according to the preliminary estimate, during the nine months of 2021, the real GDP growth was high and equaled to 11.3%, which helps to maintain debt burden at the sustainable level. In addition, the recovery of capital buffers released in the beginning of the crisis and planned improvement in the capital level and quality before the crisis (according to the "Regulation on Capital Buffer Requirements for Commercial Banks within Pillar 2") will naturally serve the role of countercyclical buffer in the next period. According to the Committee’s assessment, if current lending tendency continues, credit growth is expected to be in line with the nominal economic growth. In addition, the monetary policy is tightened, which reduces the lending activity in GEL and contributes to the decline in inflation. Therefore, currently, there is no need to activate countercyclical macroprudential instruments.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations.

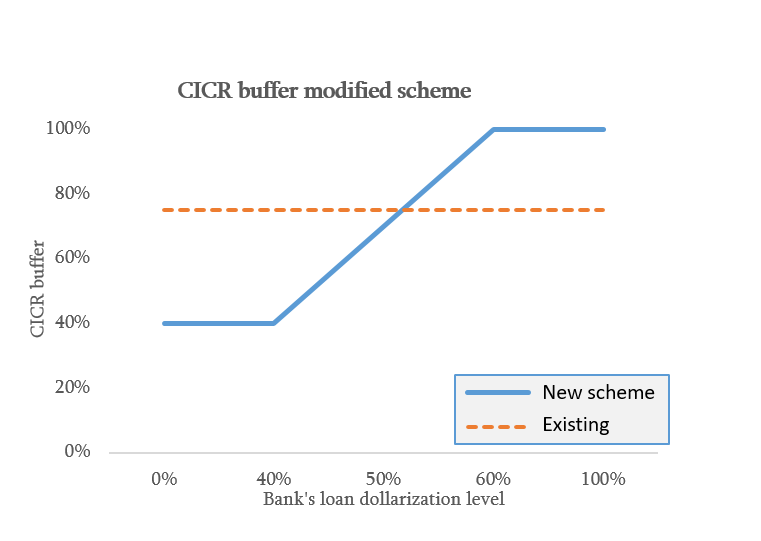

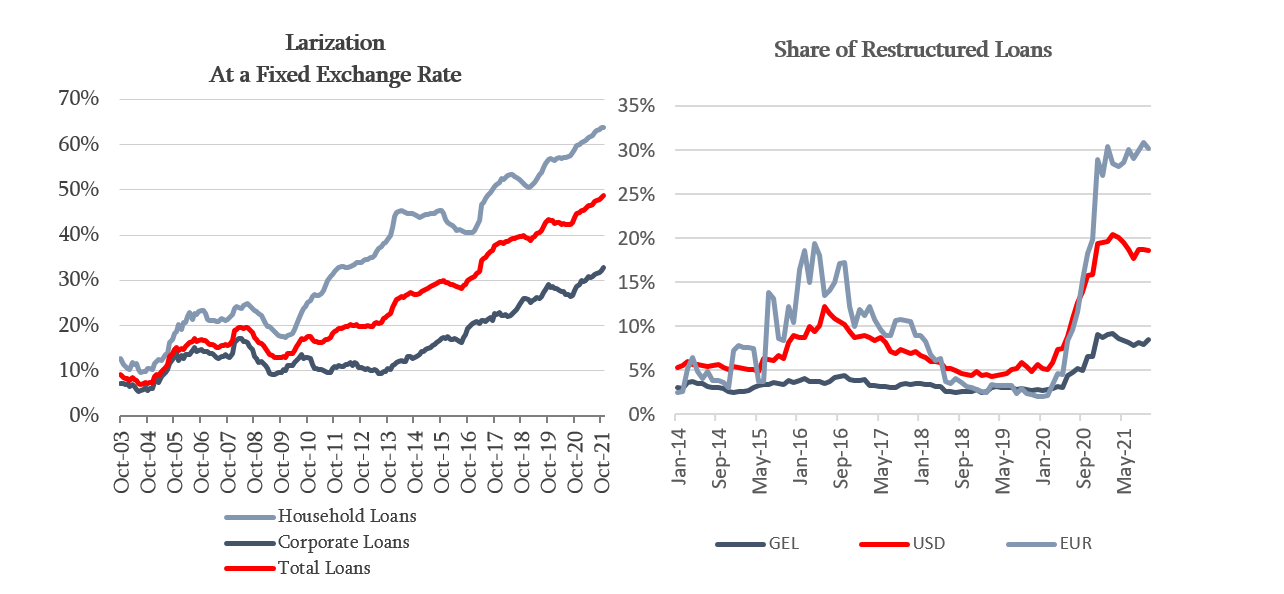

According to the committee’s decision, Currency Induced Credit Risk Buffer (CICR) will be recalibrated and it will be depend on the dollarization level of commercial banks’ credit portfolio, which will promote loan larization. As it was outlined in the previous committee’s decision, despite the significant decline, dollarization remains one of the main challenges for financial stability. In order to decrease dollarization, the National Bank of Georgia implemented a set of macroprudential measures in the pre-crisis period, which contributed to the significant decline of existing vulnerabilities. However, as long as the share of foreign currency lending in the credit portfolio is still high, dollarization remains a fundamental risk for non-hedged borrowers and for the financial system resilience. To support larization, Currency Induced Credit Risk Buffer will be determined based on the level of loan dollarization instead of existing 75% risk weight. If the dollarization is 40% or below the weight will be set at 40% and each 1 percentage point (pp) increase in dollarization will result in the rise of risk weight by 3 pp, up to 100%. In the transition phase, this rule of calculating CICR will not cause a material change in capital requirement on the system level, however, buffer requirement will be adjusted for some banks based on their dollarization level. In order to facilitate smooth transition towards the renewed scheme, the change will be activated on January 1st, 2022, however, banks, that need to increase their capital buffer, will be given 1 year to meet the requirement, while for others  the buffer requirement will be decreased immediately. This instrument will stimulate larization and along with the increasing larization, capital buffer requirement will soften over time, however, systemic risk stemming from the exchange rate will also decrease. This change, by nature, is similar to the initiative implemented in June 2021, when the minimal reserve requirement was tied to the deposit dollarization level of a commercial bank.

the buffer requirement will be decreased immediately. This instrument will stimulate larization and along with the increasing larization, capital buffer requirement will soften over time, however, systemic risk stemming from the exchange rate will also decrease. This change, by nature, is similar to the initiative implemented in June 2021, when the minimal reserve requirement was tied to the deposit dollarization level of a commercial bank.

According to the Financial Stability Committee’s decision, the maximum maturity for foreign currency mortgage loans will be decreased from 15 to 10 years. Along with the economic recovery and tightened monetary policy, the growth of foreign currency mortgage loans accelerated from April, 2021. If the existing tendency continues, the annual growth of such loans will reach 10% in 2022. It should be noted that the majority of borrowers are non-hedged, which indicates to their high vulnerability, and considering the size of the portfolio, it contributes to the accumulation of systemic risks in the financial sector. This also harms the real estate market resilience. The major part of mortgage loans are floating interest rate loans, therefore, in addition to the exchange rate risk these loans are subject to the interest rate risk, which is especially noteworthy considering historically low levels of US dollar and Euro interest rates and their potential increase. The reduction of maximum maturity for foreign currency mortgage loans will mitigate these vulnerabilities and increase the ability of borrowers to absorb stress by prolonging the loan maturity, which was efficiently used even during the ongoing pandemic. In addition, the decline of loan maturity will accelerate loan amortization, which reduces credit risk and encourages de-dollarization.

It should be noted that currently, compared to the initial period of the pandemic, when the magnitude of the pandemic can be better assessed, the potential impact of the shock on the financial sector is already largely realized. However, significant uncertainty remains, including how long the pandemic will last. The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on March 2, 2022.