Financial Stability Committee’s Decision

According to the Basel Committee recommendation the Financial Stability Committee of the NBG decided to revise the framework for setting countercyclical capital buffer. In order to accumulate capital buffers for periods of stress, Basel Committee suggested countries to set positive cycle-neutral countercyclical capital buffer. While under the current methodology a base rate for countercyclical capital buffer equals to zero and becomes positive in case of excess credit activity, a base rate for positive cycle-neutral countercyclical capital buffer is positive in normal periods as well (see the appendix to review the methodology). Increasing share of countries have already set positive buffer as their base rate. For such jurisdictions a base rate for positive cycle-neutral countercyclical capital buffer ranges from 1 to 2%. The National Bank of Georgia analyzes international experience about implementing positive cycle-neutral countercyclical capital buffer and will determine the size of the buffer on the next committee meeting.

Financial Stability Committee believes that it is important for the financial sector to accumulate capital buffers in the period of high economic growth in order to use them in the periods of stress and decided to leave the countercyclical capital buffer unchanged, at 0%, until the revised framework is officially adopted. Currently, credit activity remains at sustainable level, financial indicators of banks are improved, economic growth remains at high level, while the tendency of rising house price and rent is depicted on the real estate market. Considering current conditions, financial stability committee finds it important for the financial sector to accumulate capital buffers and use them in the periods of stress, as happened in the beginning of the pandemic. Taking into account risks coming from the current regional situation, capital buffers will help banks mitigate risks and, in the periods of stress, it will promote smooth lending and fast economic recovery.

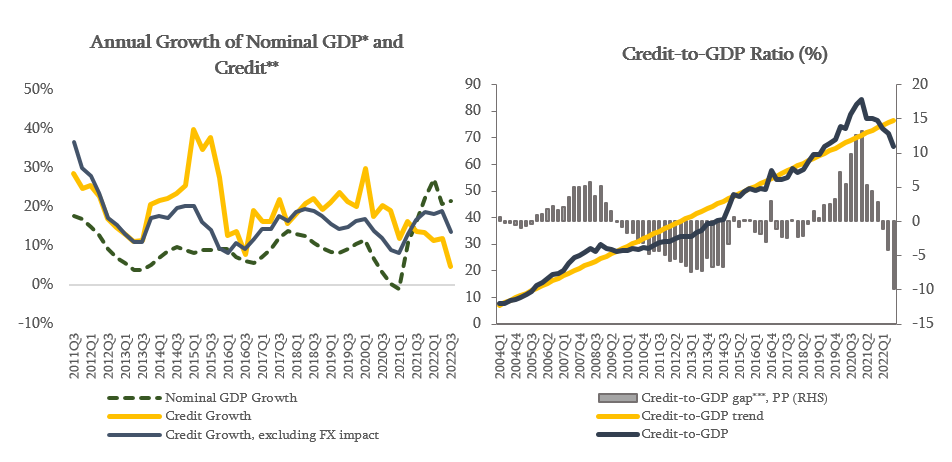

Financial Sector remains resilient and continues smooth lending to the economy. During 2022, the quality of banking sector assets, profitability and capital and liquidity ratios improved, which allowed banks to recover capital buffers before the date set by the NBG. It should be noted that, as a result of implemented measures during the year and tightened monetary policy, credit activity slowed down. In October 2022, the annual growth rate of credit portfolio, excluding the exchange rate effect, declined by 1.5 percentage points compared to August and amounted to 13.8%. The Credit-to-GDP ratio decreased during the last one year, which reflects the impact of high economic growth and exchange rate appreciation. Consequently, in the third quarter of 2022, the Credit-to-GDP ratio is below its long run trend. However, existing level of the Credit-to-GDP ratio is comparable to peer countries.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on March 15, 2023.