Financial Stability Committee’s Decision

The National Bank of Georgia published the Financial Stability Report 2022. It presents an assessment of vulnerabilities and risks in the financial system with a focus on the medium and long-term, structural features of the financial sector and the Georgian economy that are of importance for financial stability. It also analyses the resilience of the domestic financial system. In addition, the report reviews measures implemented by the NBG to ensure financial stability and assesses their impact. In particular, macroprudential measures, focused on the financial system as a whole, and microprudential measures, which strengthen the position of individual financial institutions, are reviewed in detail.

The financial sector remains resilient and continues smooth lending to the economy. The majority of banks have already restored their capital buffers released during the pandemic and hold solid capital buffers against the risks coming from the geopolitical tensions. The resilience of banks’ asset quality, supported by macroprudential measures directed towards the reduction of household indebtedness and credit dollarization, had also contributed to the readiness of the financial sector. As a result of these measures financial indicators have improved, indicating to the health of the Georgian financial system. Non-bank financial sector remains resilient as well, which were also subject to prudential measures.

Amid improved economic situation in 2022, compared to the previous year, households’ credit risk declined. During the pandemic, the deteriorated households’ creditworthiness was reflected in the increased share of non-performing loans, however, as the economy recovered, the share of non-performing loans decreased, and loan quality significantly improved. Despite the positive tendency, high growth rate of consumer loans and inflation are noteworthy. The latter is negatively reflected on households’ real income. Low income households or those with high debt burden are especially vulnerable to this risk. Besides, the increase in foreign currency interest rates, against the backdrop of globally increased inflation, is also noteworthy since it also affects the household debt service burden. Despite the declining trend, credit dollarization remains one of the main challenges. In response to these risks and for the sake of promoting borrowers’ creditworthiness the National Bank of Georgia recalibrated certain requirements in the responsible lending regulation. Namely, the maximum maturity of foreign currency mortgage loans was declined to 10 years, 25% PTI requirement was spread to the borrowers with income below 1500 GEL, it was required to consider 3 percentage point interest rate shock when assessing a borrower’s creditworthiness for floating interest rate loans and the maximum maturity for consumer loans was temporarily reduced from 4 to 3 years.

In the real estate market the trend of rising house and rent prices is detected. Which is due to increase in demand and cost of construction. Real estate market was resilient before the pandemic induced crisis, which contributed to the timely recovery of the sector. The measures taken by the government also contributed to the recovery. Considering the above-mentioned factors, significant correction of real estate prices was not evident in the previous years. During 2022, increasing dynamics of real estate prices in both national and foreign currencies is detected. The similar tendency is observed in other countries, especially after the beginning of the pandemic, which, to some extent, was driven by the transition to online work regime and therefore, the necessity of improving living conditions. Besides, as a result of increased migration, following the war, the demand for houses increased. Construction costs also increased which further rises house prices. It should be noted that capitalization index, which is a measure of investment attractiveness of property, has significantly improved. Based on the data available to the NBG, real estate market maintains resilience, however, the Russia-Ukraine war significantly increases uncertainty in the region, which might become the source of risk accumulation in the sector. The realization of risks accumulated in the real estate market can significantly affect banks’ asset quality and thus, become a source of financial stability risks. Therefore, the monitoring of the real estate market is of particular importance.

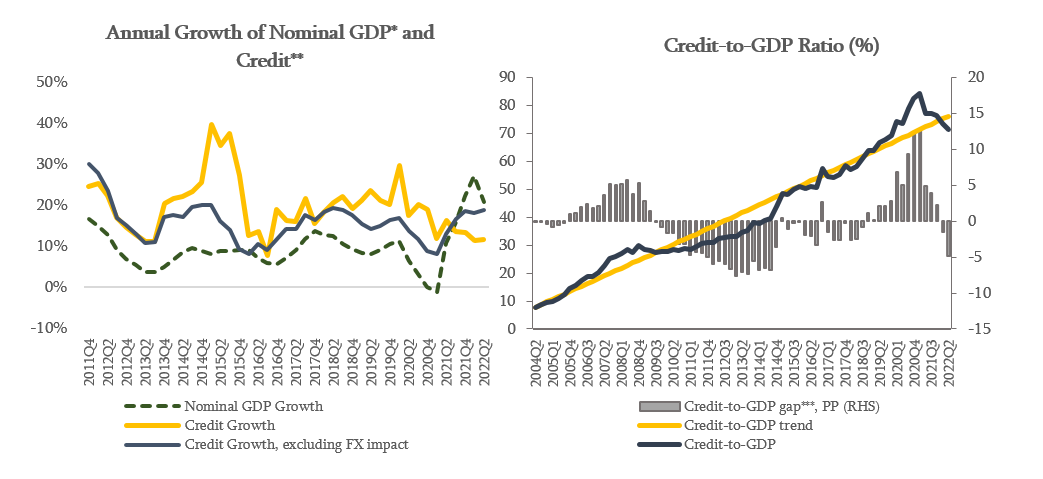

The Financial Stability Committee of the NBG decided to leave the countercyclical capital buffer unchanged, at 0%. The annual growth rate of credit portfolio in August 2022, excluding the exchange rate effect, amounted to 15.3%. The Credit-to-GDP ratio decreased during the last one year, which reflects the impact of high economic growth and exchange rate appreciation. Consequently, in the second quarter of 2022, the Credit-to-GDP ratio is below its long run trend. However, it should be noted that existing level of the Credit-to-GDP ratio is still high compared to peer countries. In the meantime, it is important for the financial sector to accumulate capital buffers in periods of high economic growth in order to use it in the periods of stress, as it happened in the beginning of the pandemic. Hence, National Bank of Georgia continues close monitoring of credit growth, banks’ financial indicators and economic growth and if the present tendency continues the NBG will consider to increase countercyclical capital buffer.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on November 30, 2022.