Financial Stability Committee’s Decision

As a result of financial stability policy implemented by the NBG, the financial sector has successfully passed through quite severe phase of the shock caused by the pandemic and maintains solid capital buffers against potential threats posed by tense geopolitical situation in the region. In the pre-crisis period, imposition of additional capital buffers, adoption of responsible lending regulation and implementation of macroprudential measures to decrease loan dollarization contributed to the robust asset quality and accumulation of solid capital buffers. In addition, imposition of Liquidity Coverage (LCR) and Net Stable Funding (NSFR) ratios promoted stability of banks’ funding and improved liquidity buffers. Consequently, as of January 2022, banks maintain healthy capital and liquidity coefficients, while asset quality has also improved compared to the same period of the previous year. Strong profitability of banks in 2021 was promoted by high credit growth and declined loan loss reserves, which, in turn, was caused by created loan loss reserves in advance in 2020. Improved financial indicators enabled most banks to recover released capital buffers and meet the expected new shock with solid capital buffers.

The war initiated by Russia against Ukraine and the corresponding sanctions imposed on Russia have significantly increased uncertainty about macroeconomic trends in the region, however, Georgian financial system is ready to withstand the stress. As it was shown in the stress test results released in December 2021, banking sector remains solvent even under severe and extreme risk scenarios. Despite potential losses, capital adequacy on aggregate level is above the minimum regulatory requirement and existing capital buffers are enough to absorb losses. Current macroeconomic events once again outlined correct, forward-looking policy pursued by the NBG to reduce dollarization.

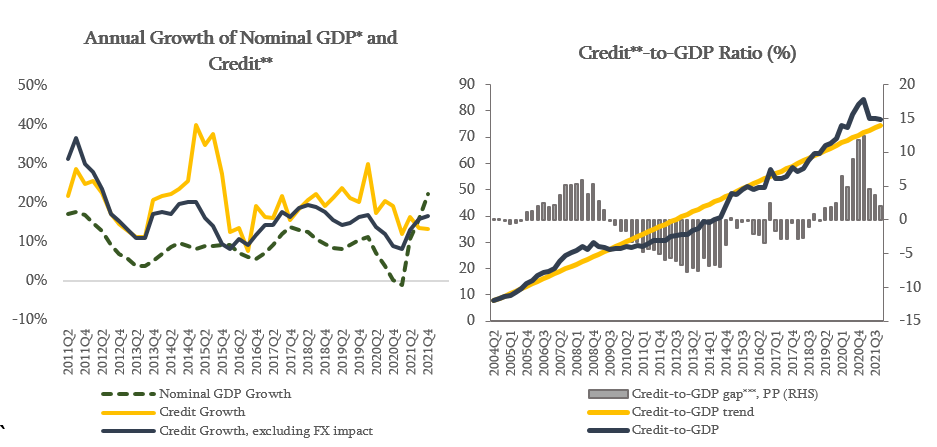

The Financial Stability Committee of the NBG decided to leave the countercyclical capital buffer unchanged, at 0%. The annual growth rate of credit portfolio in January 2022, excluding the exchange rate effect, amounted to 17.2%, which is mainly driven by the growth of business loans and from the currency perspective, by the lending in national currency. However, increasing dynamics of consumer lending is noteworthy. At the end of 2021, the Credit-to-GDP ratio still exceeds its long run trend, however, credit-to-gdp gap decreased significantly compared to the beginning of the year, which reflects the impact of high economic growth and exchange rate appreciation. According to the preliminary estimate, real GDP growth was high during the 2021 and equaled to 10.6%, which helps maintain debt burden at the sustainable level. In 2022, credit growth is expected to be in line with the nominal economic growth. Therefore, currently, there is no need to activate countercyclical macroprudential instruments.

Source: NBG; Geostat

*Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

**Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

In line with the recommendations of Financial Sector Assessment Program (FSAP), the Financial Stability Committee recalibrated particular requirements of responsible lending regulation. The initial assessment of limits on debt service coefficient was based on the statistical data available in 2017. After that, a set of nominal economic indicators increased significantly. In order to compensate these changes, if until now 25% PTI requirement was set for borrowers with the income below 1000 Gel, according to the Financial Stability Committee’s decision, this limit will increase to 1500 Gel effective from 1st April, 2022. Besides, a significant part of mortgage loans are issued with floating interest rates, which are subject to interest rate risk. This is especially noteworthy considering historically low levels of US dollar and Euro interest rates and their potential increase. In order to have necessary buffers in response to this risk, commercial banks should take into account 3 percentage point interest rate shock when assessing borrower’s creditworthiness. Effective from 1st May, 2022, PTI coefficient, calculated considering this shock, should satisfy existing requirements determined by the responsible lending regulation. These changes, aiming to maintain the shock absorbing capacity of natural persons, will promote financial stability and are consistent with the FSAP recommendations.

The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on June 1, 2022.