Financial Stability Committee's Decision

The National Bank of Georgia published the Financial Stability Report 2021. It presents an assessment of vulnerabilities and risks in the financial system with a focus on the medium and long-term structural features of the financial sector and the Georgian economy that are of importance for financial stability. It also analyses the resilience of the domestic financial system. In addition, the report reviews policies and measures implemented by the NBG to ensure financial stability. In particular, macroprudential measures focused on the financial system as a whole, and microprudential measures, which strengthen the position of individual financial institutions, are detailed.

Georgian Financial System remains resilient and continues smooth lending to the economy even in times of the pandemic. In 2021 asset quality, profitability, capital, and liquidity ratios of the banking sector will improve, which will allow banks to recover buffers, released at the beginning of the pandemic, before the date set by the NBG. It is expected that the significant share of banks will recover released buffers in the current year, while the banking sector will return to the pre-crisis capital adequacy ratio in 2022. It should be noted that identifying healthy companies by the financial institutions and providing them with credit plays an important role in economic recovery. It will promote employment growth and meanwhile financial resilience in the medium and long-term.

As a result of the COVID-19 pandemic, households’ vulnerability increased. However, with the support of the macroprudential policy implemented by the NBG in previous years, the household sector remains resilient. Proposing loan moratoria and government support programs at the start of the pandemic gave some relief to households. However, because of the severity of the shock, worsened creditworthiness led to an increase in the non-performing loan ratio. Servicing the loan was particularly hard for borrowers with a high debt burden and those with foreign currency liabilities. The realization of these risks during the pandemic showed the significance of responsible lending and larization policies implemented by the NBG. Macroprudential instruments and legislative changes contributed to the decline of household vulnerability against exchange rate volatility. It should be noted that asset quality improved along with the economic recovery.

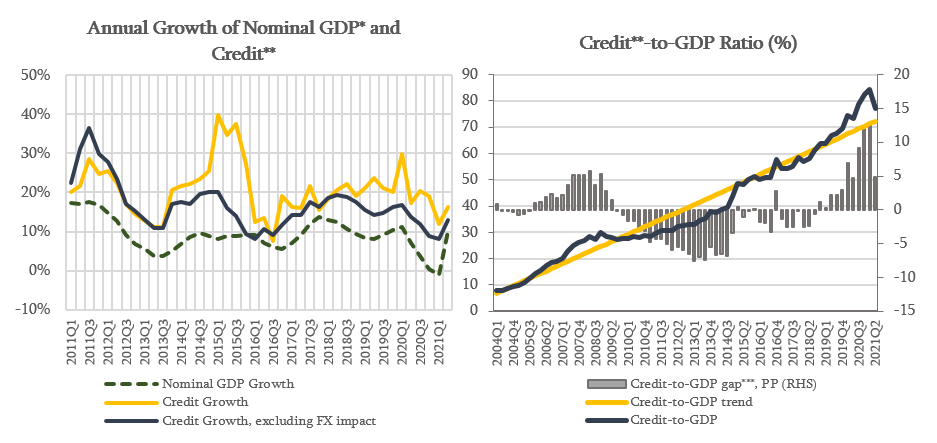

The Financial Stability Committee of the NBG decided to leave the countercyclical capital buffer unchanged, at 0%. The annual growth rate of the credit portfolio in August 2021, excluding the exchange rate effect, amounted to 15.3 percent, which is mainly driven by the growth of business loans and, from the currency perspective, by the lending in national currency. The Credit-to-GDP ratio still exceeds its long-run trend, however, the credit-to-GDP gap decreased significantly compared to previous quarters, which reflects the high economic growth and exchange rate effects. It should be noted that, according to the preliminary estimate, during the seven months of 2021, real GDP growth was higher than expected and equaled 12.2%, which helps to maintain the debt burden at a sustainable level. In addition, the recovery of capital buffers released at the beginning of the crisis and planned improvement in the capital level and quality before the crisis (according to the "Regulation on Capital Buffer Requirements for Commercial Banks within Pillar 2") will naturally serve the role of countercyclical buffer in the next period. According to the Committee’s assessment, if the current lending tendency continues, credit growth is expected to be in line with the nominal economic growth. Therefore, currently, there is no need to activate countercyclical macroprudential instruments.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations.

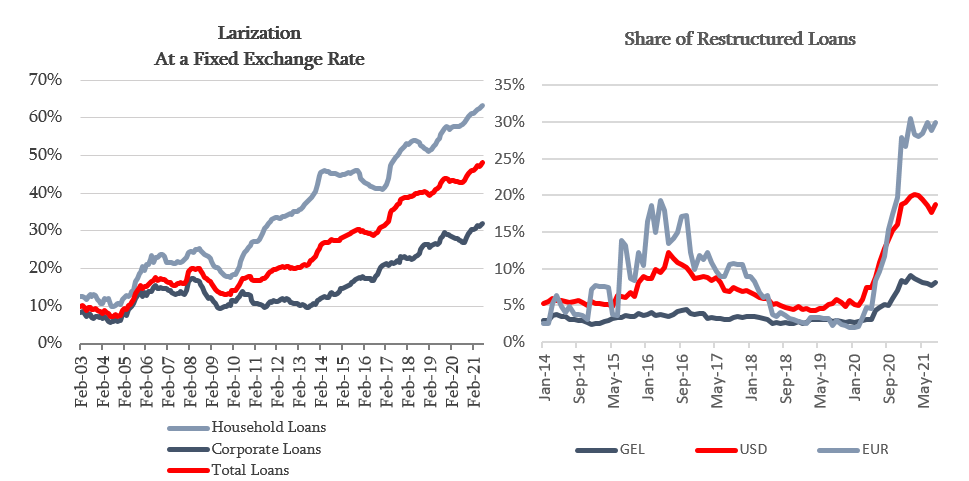

Despite the significant decline, dollarization still remains one of the major challenges for the financial sector. In the pre-crisis period, the NBG implemented a set of macroprudential measures to decrease dollarization, which contributed to the significant decline in existing vulnerability. As a result of these measures, the larization ratio for total loans has been increasing recently. In August 2021, compared to the same period of the previous year, this indicator increased by 5 percentage points and reached 48 percent. However, since the share of foreign currency loans in credit portfolio is still high, dollarization remains a major risk for non-hedged borrowers and the financial system resilience in aggregate. It should be noted that exchange rate depreciation as a result of the pandemic increased credit risk for banks, which was reflected in the rise of restructured loans in foreign currency. In particular, while the share of restructured loans issued in GEL was 8 percent in August 2021, it reached 23 percent in foreign currency.

It should be noted that currently, compared to the initial period of the pandemic, when the magnitude of the pandemic can be better assessed, the potential impact of the shock on the financial sector is already largely realized. However, significant uncertainty remains, including how long the pandemic will last. The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on November 24, 2021.