Financial Stability Committee’s Decision

The NBG publishes the 2025 Financial Stability Report. The report reviews the vulnerabilities and risks in the financial system with a focus on the medium and long-term perspectives. It also covers the structural features of the financial sector and key aspects of the Georgian economy that are of importance for financial stability. This report offers an assessment of external sector, household and corporate sectors, and real estate. It provides a detailed overview of the financial sector and presents the analysis of the resilience of the financial sector. Additionally, it reviews the measures implemented by the NBG to ensure financial stability and evaluates their impact. In particular, it reviews macroprudential measures aimed at safeguarding the financial system as a whole and microprudential measures designed to strengthen individual financial institutions.

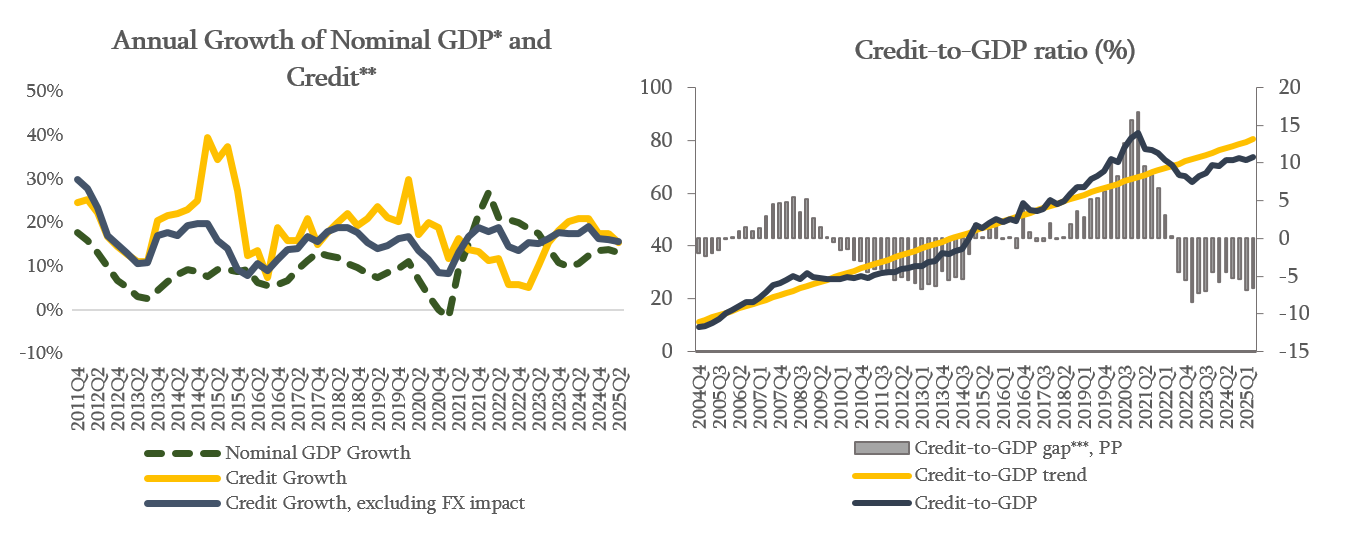

NBG’s Financial Stability Committee decided to leave the cyclical component of the countercyclical capital buffer unchanged. As of August 2025, banks maintain healthy capital and liquidity indicators. Annual growth of credit portfolio, excluding the exchange rate effect, amounted to 14.8% in August 2025, primarily driven by the growth of business loans. As of the second quarter of 2025, credit-to-GDP ratio remains below its long-run trend, while the credit-to-GDP gap is negative. Strong economic activity, observed in the first half of 2025, slowed down the pace of closing credit-to-GDP gap, however, credit-to-GDP ratio continues gradual convergence to its long-run trend. Therefore, currently, there is no need to change the cyclical component of the countercyclical capital buffer. Moreover, commercial banks continue gradual accumulation of the neutral component of the countercyclical capital buffer.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

The National Bank of Georgia continues monitoring the country’s financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize potential risks.

The Financial Stability Committee’s next meeting will be held on November 26th, 2025.