Financial Stability Committee’s Decision

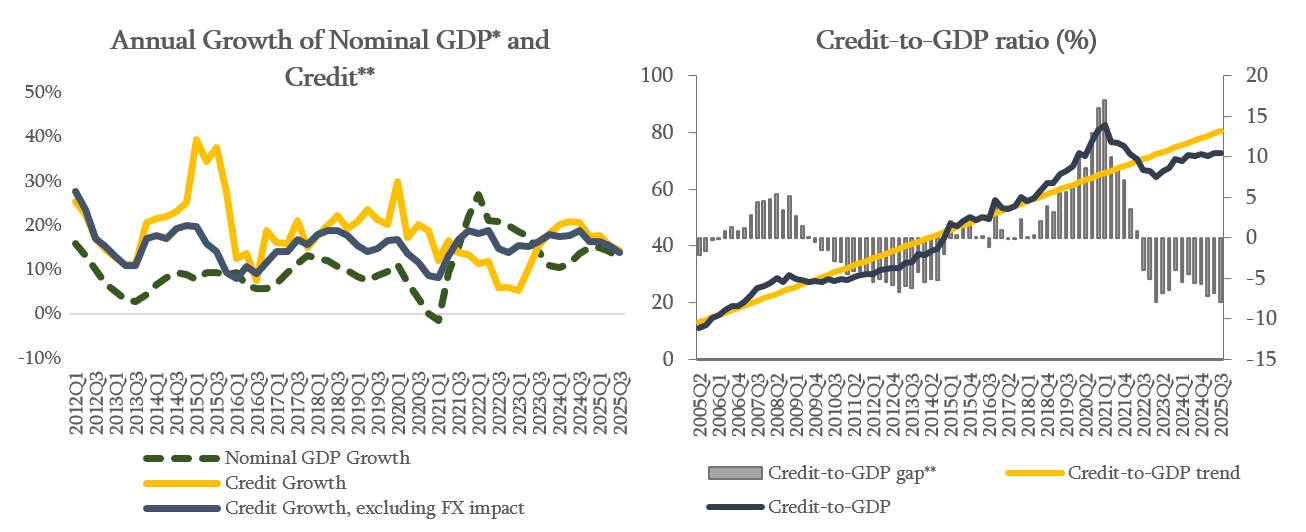

According to the NBG’s Financial Stability Committee’s decision, the cyclical component of the countercyclical capital buffer remains unchanged. As of October 2025, banks maintain healthy capital and liquidity indicators. Compared to the previous year, credit activity gradually normalized and in October 2025, annual credit growth, excluding the exchange rate effect, amounted to 12.7%. The growth was, yet again, mainly driven by the growth in business loans. As of the third quarter of 2025, Credit-to-GDP ratio remains below its long-term trend. The strong economic growth observed in the first three quarters of 2025, along with the normalization of credit activity resulted in widening of the negative Credit-to-GDP gap. According to the Committee’s assessment, with GDP growth normalizing and credit activity remaining sustainable, the negative Credit-to-GDP gap is expected to close gradually. Therefore, at the current stage, there is no need to change the cyclical component of the countercyclical capital buffer. Moreover, commercial banks continue to gradually accumulate the neutral countercyclical capital buffer.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations.

The National Bank of Georgia continues monitoring the country’s financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize potential risks.

The Financial Stability Committee’s next meeting will be held on February 25, 2026.