Financial Stability Committee’s Decision

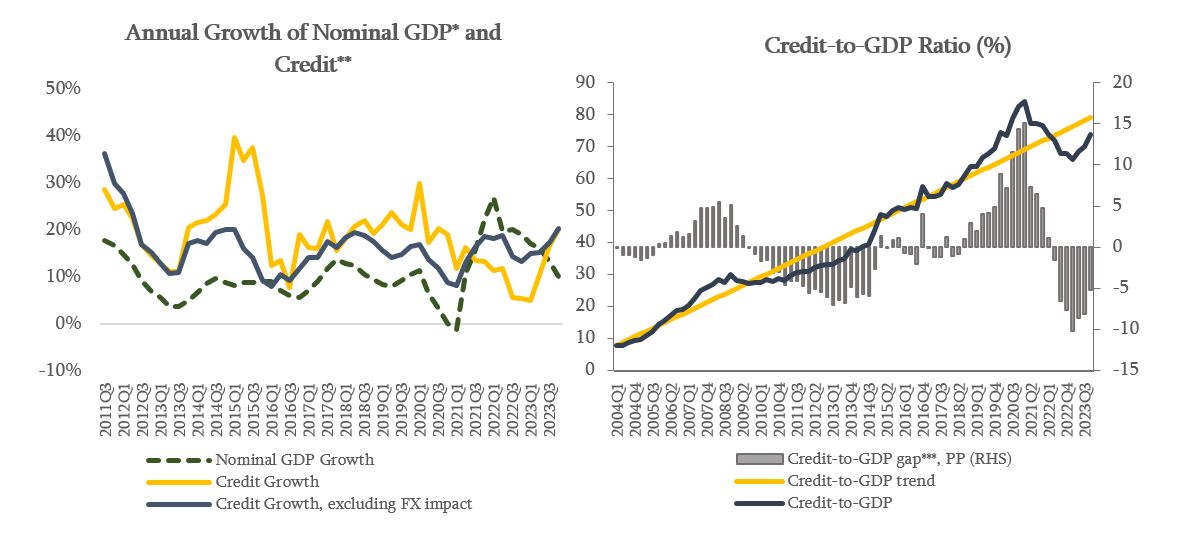

The financial sector remains resilient and continues smooth lending to the economy. As of January 2024, banks maintain healthy capital and liquidity indicators. Credit Activity is at a sustainable level. In January 2024, according to preliminary assessment, annual credit growth, excluding the exchange rate effect, amounted to 15.8%, which is mainly driven by the growth in business loans. As of the fourth quarter of 2023, Credit-to-GDP ratio gradually converges to its long-term trend. Compared to the beginning of the previous year, negative Credit-to-GDP gap is significantly reduced, which reflects the normalization of high economic growth and sustainable credit growth. According to the Committee’s assessment, if the existing tendency of credit activity and economic growth continues, the Credit-to-GDP ratio is expected to approach its long-term trend in the first half of 2024. Therefore, there is no need to change the cyclical component of the countercyclical capital buffer.

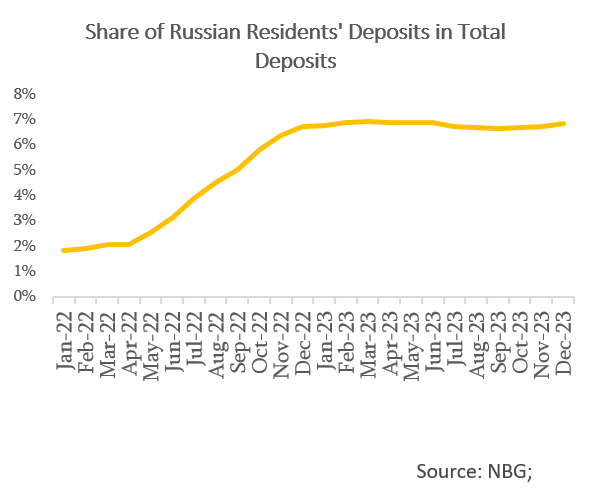

Financial Stability Committee made a decision to recalibrate the liquidity requirement for non-residents’ foreign currency deposits. Non-residents’ deposits of natural and legal persons are less stable compared to residents’ deposits. Therefore, the National Bank of Georgia maintains higher liquidity requirements for such deposits. Last year, to mitigate the risks coming from the excess growth of Russian residents’ foreign currency deposit placements in Georgia, the National Bank of Georgia decided to raise liquidity requirement (outflow rate) up to 80%. It should be noted that, thereafter the volume of Russian residents’ accounts and deposits have stabilized and the share in total deposits decreased. Besides, a major part of these funds is maintained in liquid assets and there is no evidence of replacing long-term stable liabilities.

According to certain assessments and considering the geopolitical situation, a sudden outflow of these funds is less likely in the medium term. Therefore, Financial Stability Committee decided to set the similar liquidity requirement for Russian residents’ foreign currency deposits as it is for other non-resident deposits (on average, 40%). Furthermore, commercial banks are recommended to regularly analyze the composition of non-resident accounts and if necessary, mitigate the risks by the adequate internal liquidity buffer.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations.

The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on May 29, 2024.