Financial Stability and Monetary Policy Committees’ Decision

In order to mitigate the impact of globally tightened financial conditions on the local economy, according to the committee’s decision, the countercyclical capital buffer will be accumulated gradually, while the upper limit of the minimum reserve requirements for funds attracted in foreign currency will be reduced. According to the Financial Stability Committee decision, banks are required to accumulate neutral countercyclical capital buffer according to the following schedule: 0.25 percent by March 15, 2024; 0.5 percent by March 15, 2025; 0.75 percent by March 15, 2026; 1 percent by March 15, 2027. Additionally, the Monetary Policy Committee reduced the upper limit of the minimum reserve requirements for funds attracted in foreign currency from 25 percent to 20 percent. This will provide the local market with additional liquidity in foreign currency and more flexibility for buffer accumulation, which will somewhat mitigate the impact of globally tightened financial conditions on the financial sector, and as a result, improve access to finance.

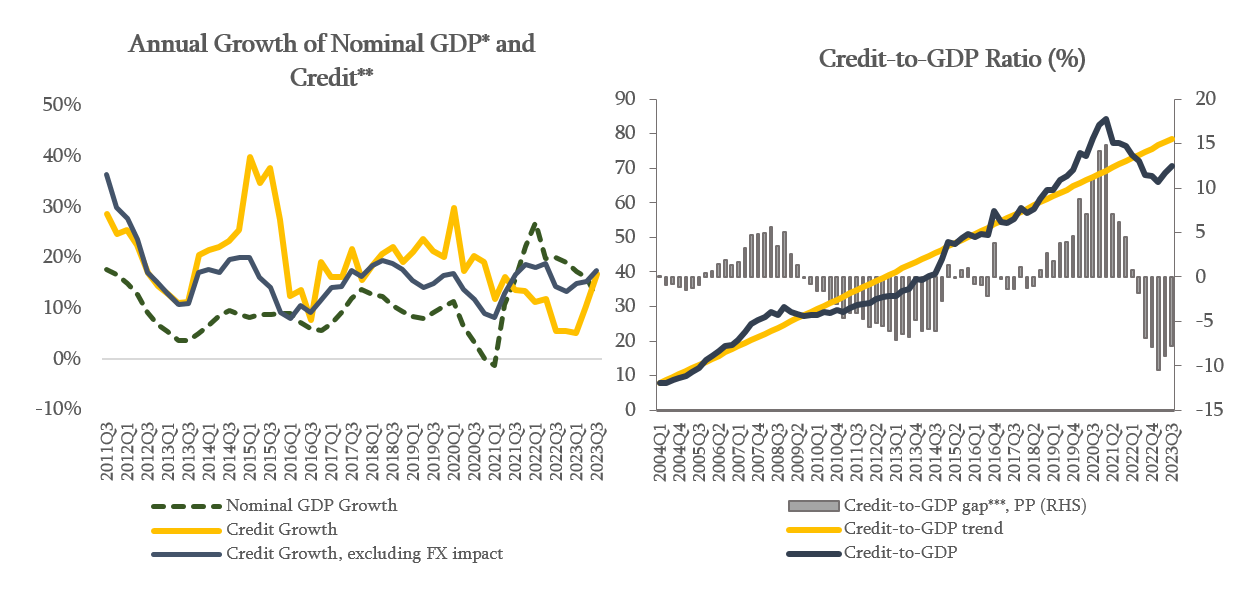

Georgian financial system remains resilient and continues smooth lending to the economy. As of October 2023, banks maintain healthy capital and liquidity indicators. Compared to last year, the quality of assets has also improved. In October 2023, annual growth of credit portfolio, excluding the exchange rate effect, amounted to 16.2%, which was mainly driven by growth of business loans. In the third quarter of 2023, credit-to-GDP ratio remains below its long-run trend, however, compared to the beginning of the year, the negative gap of credit-to-GDP ratio has decreased, which reflects the normalization of economic growth and sustainable credit activity. According to the Committee’s assessment, if the existing tendency of credit activity and economic growth continues, the credit-to-GDP ratio is expected to converge to its long-term trend in 2024. Therefore, at the current stage, there is no need to change the cyclical component of the countercyclical capital buffer.

The NBG, in cooperation with the banking sector, continues working on the long-term strategy to reduce the structural risks caused by the high level of financial dollarization. The high level of dollarization and related risks remain a significant challenge for the Georgian financial sector. To mitigate the risks, the NBG takes planned steps. During the previous committee, the limit to unhedged foreign currency loans increased to 300,000 GEL. For continuous reduction of the structural risks, the NBG in coordination with commercial banks will gradually increase this limit taking into account the current macroeconomic environment and risks.

Source: NBG, GeoStat.

* Nominal GDP growth reflects the annual GDP growth of the last 4 quarters.

** Loans include loans issued by banks, microfinance organizations and loan issuing entities, as well as bonds issued locally by companies.

*** Credit-to-GDP gap constitutes the difference between credit-to-GDP ratio and its long-term trend. To evaluate the trend, HP filter is used in accordance with the Basel recommendation.

The NBG continues monitoring the country’s financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee’s next meeting will be held on February 28, 2024.