Financial Stability and Monetary Policy Committees’ Decision

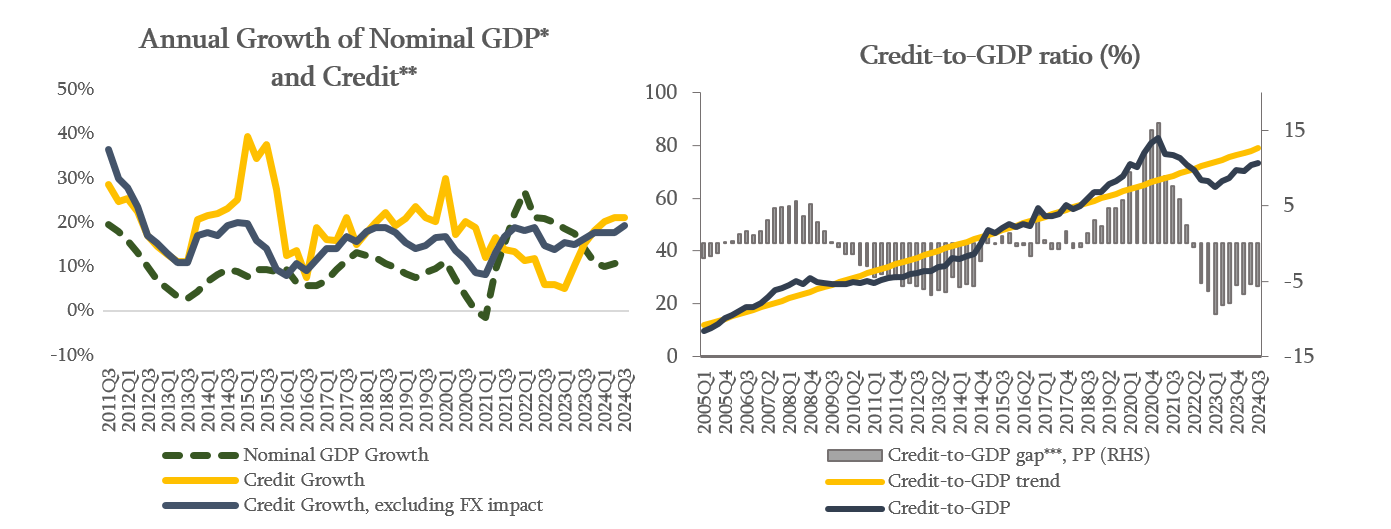

The financial sector remains resilient and continues smooth lending to the economy. As of October 2024, banks maintain healthy capital and liquidity indicators. In October 2024, annual credit growth, excluding the exchange rate effect, amounted to 18.6%, which was mainly driven by the growth in business loans. As of the third quarter of 2024, the Credit-to-GDP ratio remains below its long-term trend. Due to the strong economic growth observed in the first three quarters of 2024, the closing of the Credit-to-GDP gap slowed. However, the Credit-to-GDP ratio continues to gradually approach its long-term trend. According to the Committee’s assessment, if the existing tendency of credit activity continues and GDP growth starts to normalize, the Credit-to-GDP ratio is expected to approach its long-term trend in the first half of 2025. Therefore, there is no need to change the cyclical component of the countercyclical capital buffer. Moreover, commercial banks continue to gradually accumulate the neutral countercyclical capital buffer.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

The NBG continues working on reducing the structural risks caused by the high level of financial dollarization. As a result of the NBG’s policies, dollarization decreased significantly; however, dollarization and related risks remain a significant challenge for the Georgian financial sector. In consistency with the announced policy, the NBG, in coordination with the industry, and taking into account the macroeconomic environment and risks, continues implementing the long-term de-dollarization plan. According to the Financial Stability Committee’s decision, starting from January 1, 2025, the limit on unhedged foreign currency loans will increase from 400,000 GEL to 500,000 GEL. The NBG continues monitoring the dollarization of the deposits, which increased in October amid the uncertainty and supported the accumulation of excess liquidity of foreign currency in the financial system. To prevent excess liquidity from turning into dollarization of loans, the Monetary Policy Committee increased the upper limit of the minimum reserve requirements for funds attracted in foreign currency by 5 percentage points.

The National Bank of Georgia continues monitoring the country’s financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize potential risks.

The Financial Stability Committee’s next meeting will be held on February 26, 2025.