Financial Stability Committee's Decision

Financial Stability Committee of the

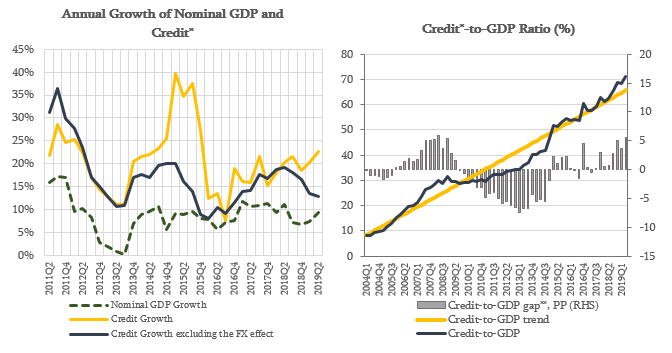

National Bank of Georgia made a decision to leave the countercyclical buffer

unchanged, at 0%. Since the regulation of responsible lending to natural

persons came into force in January 2019, the growth of loans has been following

the expected tendency. The annual growth rate of credit portfolio in August

2019 amounted to 14.6%, excluding the exchange rate effect, which is mainly due

to the growth of loans to legal entities. It should be noted that Credit-to-GDP

ratio still exceeds its long run trend, mainly due to exchange rate effect and

the excessive credit growth in past periods. According to the Committee's

assessment, the lending growth will converge to its sustainable level in the

medium term.

Source: NBG; Geostat

* Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

The National Bank of Georgia is actively pursuing the development of a financial stability policy framework. Promoting financial stability as a precondition for sustainable economic growth is one of the fundamental goals of the NBG. To this end, the NBG employs macroprudential policy that aims to prevent the build-up of systemic risks in order to decrease the probability of crisis and strengthen the resilience of the financial sector. Within the financial stability framework, the NBG has developed two important documents - the Financial Stability Report and the Macroprudential Policy Strategy.

The National Bank of Georgia has renewed the issuance of the Financial Stability Report, which will be published annually. It presents an assessment of vulnerabilities and risks in the financial system with a focus on the medium and long-term, structural features of the financial sector and the Georgian economy that are of importance for financial stability. It also analyses the resilience of the domestic financial system. In addition, the report reviews policies and measures implemented by the NBG to ensure financial stability. In particular, macroprudential measures, focused on the banking system as a whole, and microprudential measures, which strengthen the position of individual financial institutions, are detailed.

In order to make macroprudential policy operational, transparent and accountable, the NBG publishes Macroprudential Policy Strategy. The Strategy lays down the cornerstones for implementing macroprudential policy in Georgia with a view to fostering the decision-making process as well as communication and accountability to the general public. The NBG's Macroprudential Policy Strategy closely follows the European Systemic Risk Board's (ESRB/2013/1) recommendation and the best international practice and taking into account Georgia's specifics, identifies five intermediate objectives of macroprudential policy:

- Mitigate and prevent excessive credit growth and leverage.

- Mitigate and prevent excessive maturity mismatch and market illiquidity.

- Limit direct and indirect exposure concentrations.

- Limit the systemic impact of misaligned incentives with a view to reducing moral hazard.

- Reduce dollarization of the financial system.

These intermediate objectives are mapped into corresponding indicators and macroprudential policy instruments, which are necessary to achieve these objectives.

The National Bank of Georgia continues to monitor the country's financial stability and assess domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on November 27, 2019.