Financial Stability Committee’s Decision

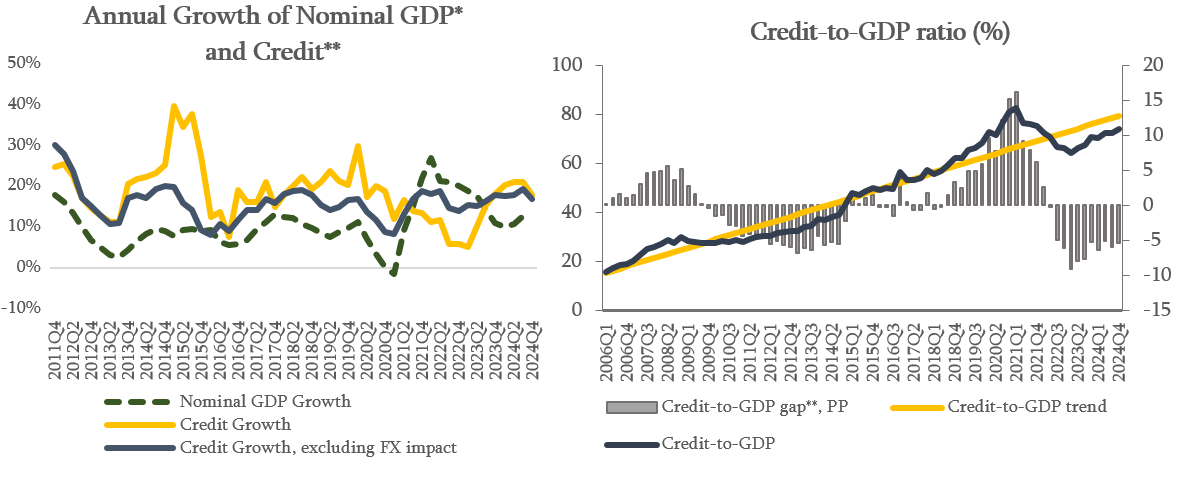

The financial sector remains resilient and continues smooth lending to the economy. As of January 2025, banks maintain healthy capital and liquidity indicators. In January 2025, annual credit growth, excluding the exchange rate effect, amount to 18.1%, which was mainly driven by the growth in business loans. As of the fourth quarter of 2024, Credit-to-GDP ratio remains below its long-term trend. Due to the strong economic growth observed in previous year, the closure of the Credit-to-GDP gap slowed. However, Credit-to-GDP ratio continues to gradually approach its long-term trend. According to the Committee’s assessment, if the existing tendency of credit activity continues and GDP growth starts to normalize, the negative Credit-to-GDP gap is expected to close in the first half of 2025. In light of economic activity normalization, to maintain stable activity in the real estate market, the National Bank temporarily increases the maximum loan-to-value (LTV) ratio by 5 percentage points to 90% for local currency loans secured by real estate, issued to natural persons. Additionally, for individuals receiving income from abroad, the LTV ratio for mortgage loans will be raised by 10 percentage points to 80%. The mentioned changes will enhance the affordability of mortgage loans.

Currently, there is no need to change the cyclical component of the countercyclical capital buffer. Commercial banks continue to gradually accumulate the neutral countercyclical capital buffer.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

The National Bank of Georgia continues monitoring the country’s financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize potential risks.

The Financial Stability Committee’s next meeting will be held on May 28, 2025.