Financial Stability Committee's Decision

The National Bank of Georgia published the Financial Stability Report 2020. It presents an assessment of vulnerabilities and risks in the financial system with a focus on the medium and long-term, structural features of the financial sector and the Georgian economy that are of importance for financial stability. It also analyses the resilience of the domestic financial system. In addition, the report reviews policies and measures implemented by the NBG to ensure financial stability. In particular, macroprudential measures, focused on the financial system as a whole, and microprudential measures, which strengthen the position of individual financial institutions, are detailed.

The Georgian financial system faced the COVID-19 pandemic well prepared and it maintains resilience owing to the financial stability policy measures implemented in recent years. As a result of COVID-19 pandemic, economic activity declined and risks to financial stability amplified worldwide. However, additional capital requirements imposed by the NBG and profits gained by banks in previous periods enabled banks to build up sufficient capital buffers to handle such stress. Besides, in the pre-crisis period, the NBG implemented a number of macroprudential measures to reduce high level of household indebtedness and loan dollarization. These measures have reduced vulnerabilities in the non-financial sector and built up resilience of the financial system. In addition, in the previous years the NBG imposed Liquidity Coverage (LCR) and Net Stable Funding (NSFR) ratios, which promoted market liquidity and stability of banks' funding. As a result, the Georgian financial system is resilient and it has accumulated sufficient liquidity and capital buffers to mitigate shocks caused by the COVID-19 pandemic. In order to further support financial intermediation, in the very first months of the pandemic the NBG activated new liquidity instruments. Also, microfinance organizations, which were imposed prudential requirements in recent years, remain resilient. Due to the pandemic, the share of nonperforming loans is expected to increase. However, commercial banks have made loan loss provisions in advance and it is expected, that operational profitability will significantly offset these losses. Consequently, the banking system has enough resources to continue providing loans to the economy without any difficulties.

COVID-19 pandemic and the necessary measures implemented to avoid its rapid spread increased financial vulnerability of the household and non-financial corporations sectors, that negatively affected financial sector. However, measures implemented by the NBG and the government significantly reduce impact of COVID-19. The shock caused by the pandemic significantly hampered economic activity that led to the decline in employment and income. These caused significant financial distress for households and non-financial corporations. In this regard, the loan deferral programs offered by lenders, which eased the financial conditions of temporarily insolvent borrowers, were critical. To maintain lending to the real economy, The National Bank of Georgia developed a temporary supervisory plan, which implies to use the capital and liquidity buffers of the banking sector during the financial stress. In order to further ensure that the banking system has sufficient liquidity, the NBG activated swap operations. Also, the National Bank of Georgia launched new liquidity instrument to support SME financing. In order to further ensure that the banking system has sufficient liquidity, the NBG activated swap operations. Also, the National Bank of Georgia launched new liquidity instrument to support SME financing. By using this instrument, commercial banks will have the opportunity to receive liquidity support from the NBG against collateral of the SME loan portfolio. This tool can be used by the microfinance organizations as well, and therefore, SME sector will be able to attract funding easily. In order to support liquidity in foreign currency in the FX market, the NBG activated a new rule based mechanism of interventions. It should be noted that the NBG's macroprudential efforts have been assisted by the government's actions, which provide support to economic growth and to the sectors most affected by COVID-19.

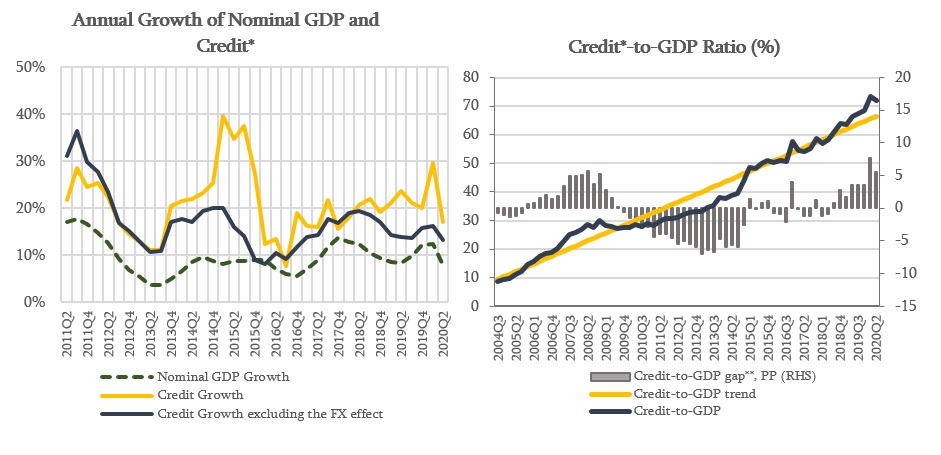

As stated in the previous statement of the Financial Stability Committee, the National Bank will not increase the requirement for countercyclical buffers this year. The annual growth rate of credit portfolio in August 2020, excluding the exchange rate effect, amounted to 12%. In terms of currencies, over the last two years in the share of foreign currency loans there has been a growing trend of loans in Euro, which, on the one hand, somewhat reduces currency risk at the system level through diversification, but on the other hand, this trend requires attention due to increasing vulnerability to the Euro. It should be noted that Credit-to-GDP ratio still exceeds its long run trend, which reflects the high credit growth and exchange rate effects in previous periods. Increased gap indicates the raised debt burden and vulnerability, especially, in the corporate sector. On the other hand, credit activity slowed down significantly after the spread of the Coronavirus, but has increased again in the recent months and if this tendency continues, the growth of loan portfolio will be around 5%-10%. Under these circumstances, increasing the countercyclical buffer or capital buffers released in March will not be required during this year. In the future, banks will be given reasonable time to accumulate capital buffers without facing significant hardship.

Source: NBG; Geostat

* Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

It should be noted that currently, compared to the initial period of pandemic, we can better assess the magnitude of the shock and its potential impact is already largely reflected on the financial sector. However, significant uncertainty remains, including how long the pandemic will last. The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on November 25, 2020.