Financial Stability Committee’s Decision

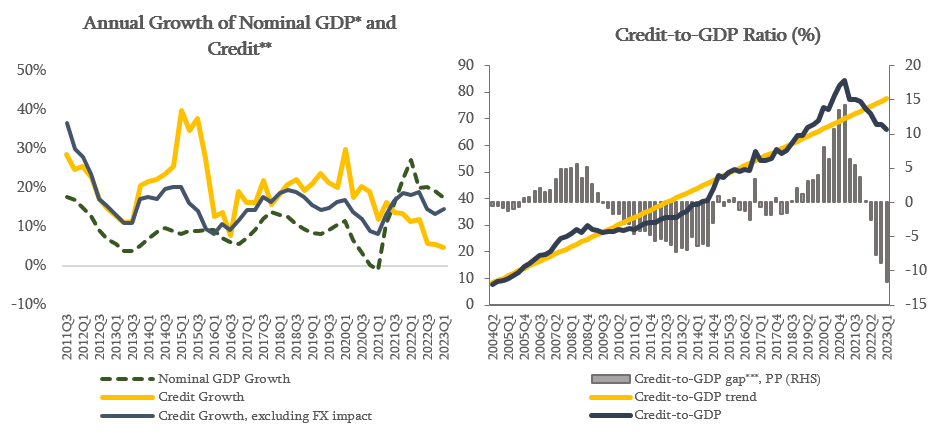

The Financial Stability Committee of the NBG decided to leave the countercyclical capital buffer unchanged, at its base rate (1%). Currently, credit activity remains at a sustainable level, banks maintain healthy capital and liquidity requirements, while asset quality has improved compared to the previous year. The annual growth rate of the credit portfolio in April 2023, excluding the exchange rate effect, amounted to 13.2%. The Credit-to-GDP ratio has been decreasing during the last two years, which reflects the impact of high economic growth and exchange rate appreciation. Consequently, in the first quarter of 2023, the Credit-to-GDP ratio is below its long run trend, however, it should be noted that the existing level of the Credit-to-GDP ratio in Georgia is comparable to levels in peer countries. According to the Committee’s assessment, if the existing tendency of credit activity continues, the growth of credit portfolio is expected to be in line with nominal economic growth in the current year. Therefore, currently, there is no need to change countercyclical capital buffer.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

Financial Stability Committee made a decision to raise liquidity requirement for non-residents’ foreign currency deposits. The National Bank of Georgia maintains higher liquidity requirements for non-residents’ deposits of natural and legal persons compared to residents’ deposits due to historically less stable character of non-residents’ deposits. After Russian invasion in Ukraine, Russian residents’ foreign currency deposit placements in Georgia increased materially, which creates concentration risk and adversely affects liquidity position of the system. Also it should be noted, that previously banks directed these funds in liquid assets and from 2023 there is a noticeable trend of replacing high cost funding with these sources (Table 1). Therefore, as inflows of above mentioned funds may be temporary it is reasonable to place them in liquid assets. Financial stability Committee decided to raise liquidity requirement (outflow rate) up to 80% for foreign currency deposits of Russian residents. Outflow rate previously ranged between 30-40%. Above mentioned change is effective from 1st of September 2023.

Table 1. Structure of Foreign Currency Funding |

||

Dec-21 |

Apr-23 |

|

| Borrowed Funds | 24% | 19% |

| Resident Deposits | 57% | 53% |

| Non-Resident Deposits | 15% | 22% |

| Other Liabilities | 4% | 6% |

Source: NBG.

The National Bank sets the Minimum Requirement for Own Funds and Eligible Liabilities (MREL) for systemically important commercial banks to further support financial stability1. The recommendation to establish this requirement was given in 2021 with the joint Financial Sector Assessment Program of Georgia by the International Monetary Fund and the World Bank, and the regulation is based on the common practice envisaged by the framework of the European Bank Recovery and Resolution Directive (BRRD). The purpose of the MREL is to ex-ante create such a structure of balance sheets by commercial banks, which will contribute to the stability of the bank through recapitalization in a stressed situation. (See more information)

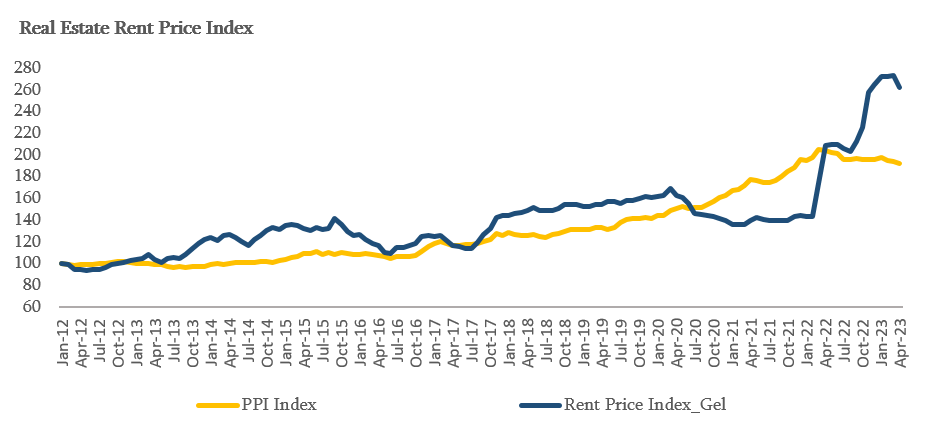

The real estate rental price index still remains at an elevated level. During the previous years, there has been a tendency of rising real estate prices and rent, which, on the one hand, is driven by increased demand and on the other hand, higher construction costs. After the Russian invasion in Ukraine, the demand for real estate has risen due to increased migration.

The real estate price growth is mostly in line with the increase in construction costs and industrial inflation. While, in the case of rent, there is a larger scale growth and the rent price exceeds its long run trend by about 30%. Considering this fact, the National Bank of Georgia recommends financial institutions to account for this dynamic in the assessment of rental income stability when issuing a loan.

Source: NBG, GeoStat.

The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on September 27, 2023.

____________________________________________

1The order of imposing the requirement will be available on matsne.gov.ge in the coming days.