Financial Stability Committee’s Decision

15 June, 2018

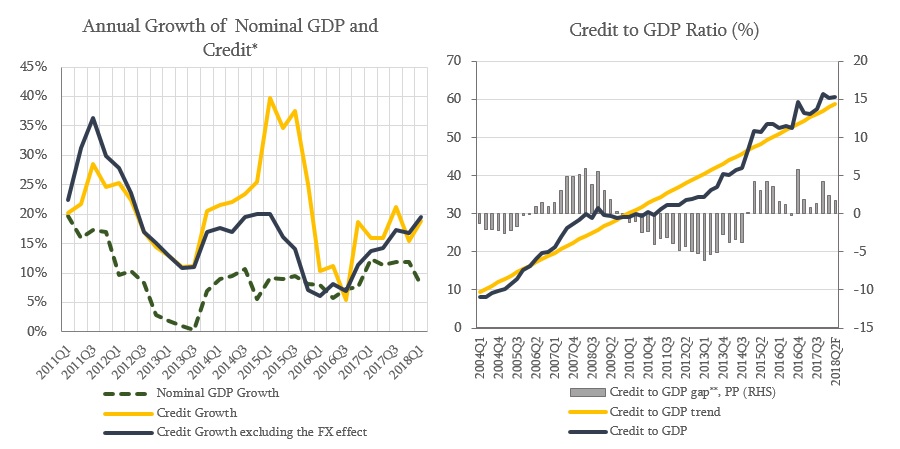

On June 14 2018, the Financial Stability Committee of the National Bank of Georgia made a decision to leave the countercyclical buffer unchanged, at 0%. According to the Committee's assessment, the total credit growth is in line with the nominal GDP growth. In the first quarter of 2018, the annual growth rate of loans, excluding the exchange rate effect, was 19.6 percent. Positive trends in the foreign sector contribute to the growth of the Georgian economy. In the first quarter of 2018, annual growth of real GDP was higher than expected and reached 5.2 percent. However, despite improvements, aggregate demand is still lagging behind the potential level of output. Credit-to-GDP ratio is within 60 percent and is close to its long-run trend, which is estimated according to the Basel methodology. It is important to have a credit growth that is in line with economic activity and supports sustainable growth of the economy and the welfare of society, without accumulating excessive financial stability risks.

Source: NBG; Geostat

* Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations.

In the first quarter of 2018, compared to the previous quarter, the annual growth rate of mortgages and loans to individual entrepreneurs increased, while the growth rate of consumer loans decreased. Household debt increased by 21.4 percent annually and as of the first quarter of 2018, is within 35 percent of gross domestic product. Along with the economic development, household debt-to-GDP ratio is expected to increase, but it is important that the growth rate remains moderate and does not cause accumulation of systemic risks. Financial institutions often reflect the risk associated with households’ over-indebtedness in higher interest rates; however, they do not take into account the accompanying negative events that results from the increased share of insolvent labor force in the economy. It is important to avoid establishment of the growing mass of people with financial problems, which will have limited access to bank accounts and reduced possibility of formal economic activity. In response to this, during 2017-2018 the NBG gradually introduces responsible lending standards according to the best international practices and requirements of the Euro-Directives.

The National Bank has publicly shared a working version of the issuanceof loans to individuals, which will be updated after consideration with market participants and will be launched from January 1st, 2019. According to the draft, financial institutions should issue loans based on detailed analysis of the customer's creditworthiness. Prior to the enactment of the new regulation - during the transition period- to avoid the aggressive growth of loans with low credit standards, the total amount of loans that banks can issue without analysis of customer’s creditworthiness were limited to 25 percent of the bank's supervisory capital. According to the same regulation, it is planned to introduce maximum limits on Loan to Value (LTV) and Payment to Income (PTI) coefficients, which will be also applied to non-banking sector. In addition, the Parliament considers the legislative amendments to reduce the maximum effective interest rate limit up to 50 percent, which will also facilitate the shrinking of high-risk products on the market.

Corporate credit growth is moderate. In the first quarter of 2018, the growth of corporate credit issued by banks amounted to 14.7 percent, excluding the exchange rate effect. However, in case of corporates, alternative sources of financing, such as foreign direct loans and corporate bonds, should also be taken into account. According to March 2018 data, the share of foreign direct financing in the total corporate credit is 52 percent and the share of bonds is 1.8 percent. It should be noted that the corporate bond market is characterized by rapid growth since 2016 and is expected to increase further in line with the capital market development. As the economy recovers from the external shock, financial conditions of the companies improve, which is reflected in the reduction of NPLs.

The banking sector maintains high liquidity and capitalization. In December 2017, within the Basel III framework new norms of capital adequacy were introduced, under which banks’ capital quality was improved and became more risk-oriented. It should be noted that share of NPLs in total credit has decreased over the recent period.

Despite the decline, dollarization remains one of the main challenges for the financial sector. The Committee considers that the large share of foreign currency liabilities in the total bank financing requires attention amid increasing foreign interest rates. The NBG regularly assesses the sensitivity of the banking sector towards stressful scenarios; the results of the assessment show that the banking sector is highly resistant to the foreign interest rate risk. In order to increase the resilience of the financial sector towards credit risk, the Committee decided to make the amendment to the regulation on assets classification and the creation and use of reserves for losses by commercial banks. In particular, starting from September 1st, the difference between the maximum rates of foreign and local currency loans to value (LTV) and payment to income (PTI) coefficients will be increased from 5 to 10 percent points, which is an additional measure to support larization.

The National Bank of Georgia continues to monitor the country's financial stability, assess domestic and foreign risks and, if necessary, will use all available instruments to minimize the possible risks.

The Financial Stability Committee’s next meeting will be held on September 27.

In order to increase transparency and effectiveness of financial stability policy, from 2018 the Financial Stability Committee (FSC) moved onto the new framework. The FSC meets once a quarter according to the preannounced calendar, and after each meeting a press release is published. It describes the current trends and challenges in the financial system, and the decisions of the committee. Moreover, twice a year committee meeting is followed by a press conference.

The FSC regularly assesses and analyzes external risks, domestic macro-financial environment, risks related to households and companies, systemic risks of banking and non-banking sectors. Based on this analysis, the Committee makes a decision regarding the macroprudential policy instruments, such as: countercyclical capital buffer, additional capital requirements, limits on Loan-to-Value and Payment-to-Income ratios, liquidity requirements, etc.

The National Bank has publicly shared a working version of the issuanceof loans to individuals, which will be updated after consideration with market participants and will be launched from January 1st, 2019. According to the draft, financial institutions should issue loans based on detailed analysis of the customer's creditworthiness. Prior to the enactment of the new regulation - during the transition period- to avoid the aggressive growth of loans with low credit standards, the total amount of loans that banks can issue without analysis of customer’s creditworthiness were limited to 25 percent of the bank's supervisory capital. According to the same regulation, it is planned to introduce maximum limits on Loan to Value (LTV) and Payment to Income (PTI) coefficients, which will be also applied to non-banking sector. In addition, the Parliament considers the legislative amendments to reduce the maximum effective interest rate limit up to 50 percent, which will also facilitate the shrinking of high-risk products on the market.

Corporate credit growth is moderate. In the first quarter of 2018, the growth of corporate credit issued by banks amounted to 14.7 percent, excluding the exchange rate effect. However, in case of corporates, alternative sources of financing, such as foreign direct loans and corporate bonds, should also be taken into account. According to March 2018 data, the share of foreign direct financing in the total corporate credit is 52 percent and the share of bonds is 1.8 percent. It should be noted that the corporate bond market is characterized by rapid growth since 2016 and is expected to increase further in line with the capital market development. As the economy recovers from the external shock, financial conditions of the companies improve, which is reflected in the reduction of NPLs.

The banking sector maintains high liquidity and capitalization. In December 2017, within the Basel III framework new norms of capital adequacy were introduced, under which banks’ capital quality was improved and became more risk-oriented. It should be noted that share of NPLs in total credit has decreased over the recent period.

Despite the decline, dollarization remains one of the main challenges for the financial sector. The Committee considers that the large share of foreign currency liabilities in the total bank financing requires attention amid increasing foreign interest rates. The NBG regularly assesses the sensitivity of the banking sector towards stressful scenarios; the results of the assessment show that the banking sector is highly resistant to the foreign interest rate risk. In order to increase the resilience of the financial sector towards credit risk, the Committee decided to make the amendment to the regulation on assets classification and the creation and use of reserves for losses by commercial banks. In particular, starting from September 1st, the difference between the maximum rates of foreign and local currency loans to value (LTV) and payment to income (PTI) coefficients will be increased from 5 to 10 percent points, which is an additional measure to support larization.

The National Bank of Georgia continues to monitor the country's financial stability, assess domestic and foreign risks and, if necessary, will use all available instruments to minimize the possible risks.

The Financial Stability Committee’s next meeting will be held on September 27.

In order to increase transparency and effectiveness of financial stability policy, from 2018 the Financial Stability Committee (FSC) moved onto the new framework. The FSC meets once a quarter according to the preannounced calendar, and after each meeting a press release is published. It describes the current trends and challenges in the financial system, and the decisions of the committee. Moreover, twice a year committee meeting is followed by a press conference.

The FSC regularly assesses and analyzes external risks, domestic macro-financial environment, risks related to households and companies, systemic risks of banking and non-banking sectors. Based on this analysis, the Committee makes a decision regarding the macroprudential policy instruments, such as: countercyclical capital buffer, additional capital requirements, limits on Loan-to-Value and Payment-to-Income ratios, liquidity requirements, etc.

Other News