Financial Stability Committee’s Decision

The FSC regularly assesses and analyzes external risks, domestic macro-financial environment, risks related to households and companies, systemic risks of banking and non-banking sectors. Based on this analysis, the Committee makes a decision regarding the macroprudential policy instruments, such as countercyclical capital buffer, additional capital requirements, limits on Loan-to-Value and Payment-to-Income ratios, liquidity requirements, etc.

Georgian Financial system maintains resilience against potential shocks. The banking sector remains highly capitalized and liquid. Starting from early 2018, after introducing new capital adequacy requirements, the quality of capital in commercial banks has improved and became more risk-oriented. Meanwhile, in light of improved economic activity, the share of non-performing loans in total lending tends to decrease. However, it should be noted, that usually in the ascending credit cycle the share of non-performing loans decreases. Therefore, this declining trend should not be interpreted too optimistically and unequivocally concluded that the credit risk associated with loans is low. In the first 7 months of 2018, real GDP has shown higher than expected growth reaching 5.5% in annual terms. As a result the gap of aggregate output from its potential level has been diminishing. However, given the latest developments in the region, the threat of transmitting macroeconomic and financial risks to the domestic economy has surged. To some extent, this contributed to a higher volatility in domestic financial markets. The National Bank of Georgia is examining the latest developments thoroughly and implementing consistent macroprudential policy in order to ensure the resilience of financial system.

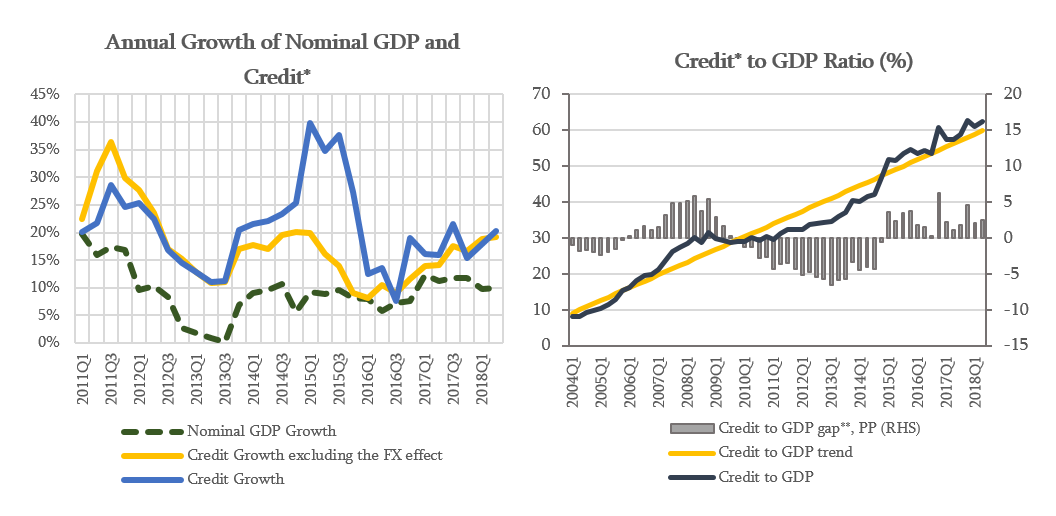

Financial Stability Committee of the National Bank of Georgia made a decision to leave the countercyclical buffer unchanged, at 0%. In August 2018, the annual growth rate of loans, excluding the exchange rate effect, was 19%, out of which the loans to individuals contributed 11.5 pp and the loans to legal entities added the other 7.5 pp. Credit-to-GDP ratio slightly exceeds its long run trend1 partially due to the exchange rate effect as well as the growth of total credit. The growth rate of loans issued to legal entities has been moderate. However, the debt of companies remains highly dollarized.

Source: NBG; Geostat

* Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector

** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

The National Bank of Georgia recommends financial institutions to take proper account of foreign currency-related interest rate risk in loan pricing. The risks related to dollarization remain a major challenge for the financial system. Recently, given the locally reduced interest rates on foreign currency loans, FX loans issued to individuals have increased. This might be an indication of underestimated foreign currency risks by borrowers as well as by banks. On the one hand, foreign currency denominated loans are exposed to exchange rate risk. On the other hand, they are accompanied by interest rate risk, which is especially noteworthy given the anticipated increase in interest rates on US dollar and Euro in global markets. In addition, the country risk premium2 should also be taken into account as it has been significantly depressed given the historically low interest rates in the aftermath of the Global Financial Crisis. Therefore, the possible impact of tightening in global financial conditions on the risk premiums of developing countries (in particular, Georgia) should also be considered when assessing foreign currency funding risks.

Within the responsible lending framework, Financial Stability Committee has decided to introduce regulation on issuance of loans to individuals. According to the regulation, financial institutions are required to issue loans based on the assessment of clients' debt repayment ability. In addition, payment-to-income (PTI) and loan-to-value (LTV) ratios should not exceed corresponding maximum norms. The norms will be differentiated by domestic and foreign currency denominated loans, which, in turn, is aimed at reducing the systemic risks induced by financial dollarization. The regulations will be enacted for commercial banks on November 1, 2018. Starting from January 1, 2019, these will be extended to all loan issuers. Additionally, starting from September 1, the maximum limit on effective interest rate on loans is set at 50%. The latter arrangement is expected to further cut down high-risk products in the market.

The National Bank of Georgia continues to monitor the country's financial stability and assess domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on November 21.

1The long run trend estimate is based on the methodology recommended by Basel

Committee

2Georgia's

sovereign risk premium is an additional interest margin for foreign investors,

which they ask for investing in Georgia. For the measurement, the difference

between yields of Eurobonds of Georgia and the US government securities is used.