Financial Stability Committee's Decision

As a result of the Financial Stability Policy implemented by the NBG, the financial sector has successfully passed through a quite severe phase of the shock caused by the pandemic. As of April 2021, banks maintain solid capital and liquidity buffers. If they follow the current year-to-date profitability trend, it is expected that banks will earn solid profits by the end of 2021. Improved profitability is supported by strong credit growth and reduced need for loan provisioning, due to loan loss reserves created in advance in 2020. It should be noted that currently, 10% of loan portfolio remains under moratoria. Meanwhile, asset quality review continues, although a material increase in the non-performing loans is not expected. According to the Committee's assessment, loan loss reserves created by banks adequately reflects the level of expected credit losses caused by the pandemic. Therefore, additional negative impact on the banks' financial indicators, in this regard, is not expected. Consequently, according to the Financial Stability Committee's assessment, the banking sector will maintain stability and will continue lending to the economy without any difficulties in 2021.

According to the Financial Stability Committee's decision, the recovery of capital buffer requirements released in the beginning of the crisis will begin on January 1, 2022 and will last for 2 years. Banks will be required to restore currency induced credit risk (CICR) buffer by January 1, 2023 and capital conservation buffer requirement by January 1, 2024. It should be noted that, from the current perspective, when the magnitude of the pandemic and the dynamics of economic recovery can be assessed better, the potential impact of the shock is already largely reflected on the financial sector. Uncertainty about the duration of the pandemic is still high, however a significant revision of credit losses in the baseline scenario is not expected. Therefore, Financial Stability Committee deemed it appropriate to begin the recovery of capital buffers released in March, 2020. January 1, 2022 is set as the starting date for the recovery of capital buffer requirements and banks are given 2 years to meet restored capital requirements. It should be noted that, other things being equal, the recovery of capital buffer requirements will not affect lending growth significantly, considering the banks' current capital buffers and expected profitability. Meanwhile, current projections allow banks to restore these buffers before the given date. In such a case, the restrictions on banks' capital distribution (dividend payout, share buybacks, equity investments and increasing variable remuneration for management) will be abolished.

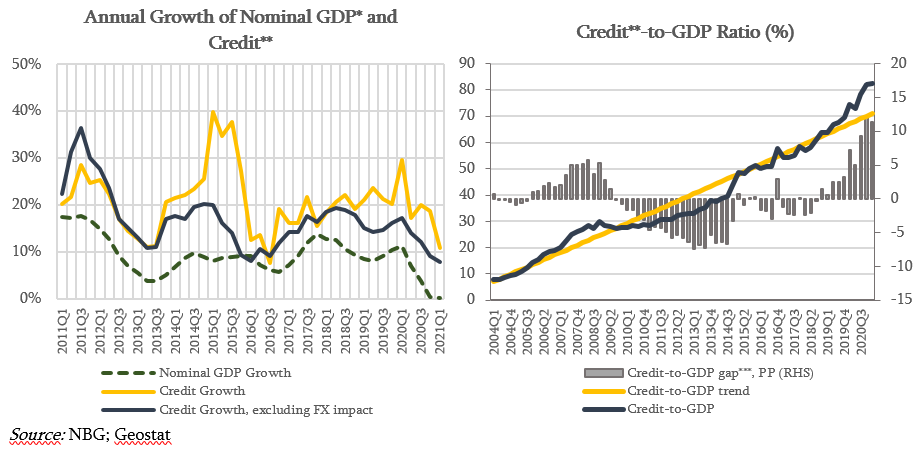

The Financial Stability Committee of the NBG decided to leave the countercyclical capital buffer unchanged, at 0%. The annual growth rate of credit portfolio in April 2021, excluding the exchange rate effect, amounted to 9.8%, which is mainly driven by the growth of business loans. At the same time, Credit-to-GDP ratio still exceeds its long run trend, which reflects the high credit growth and exchange rate effects in previous periods. It should be noted that, in the light of improving global outlook, the Georgian economy continues to recover from the shock. According to the preliminary estimate, during the four months of 2021, real GDP growth was higher than expected and equaled to 8.1%, which helps to maintain debt burden at the sustainable level. In addition, the recovery of capital buffers released in the beginning of the crisis and planned improvement in the capital level and quality before the crisis (according to the "Regulation on Capital Buffer Requirements for Commercial Banks within Pillar 2") will naturally serve the role of countercyclical buffer in the next period. According to the Committee's assessment, if current lending tendency continues, credit growth is expected to be in line with the nominal economic growth. Therefore, currently, there is no need to activate countercyclical macroprudential instruments.

Source: NBG; Geostat

* Nominal GDP growth reflects the YoY GDP growth of the last 4 quarters.

** Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

*** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on September 29, 2021.