Financial Stability Committee's Decision

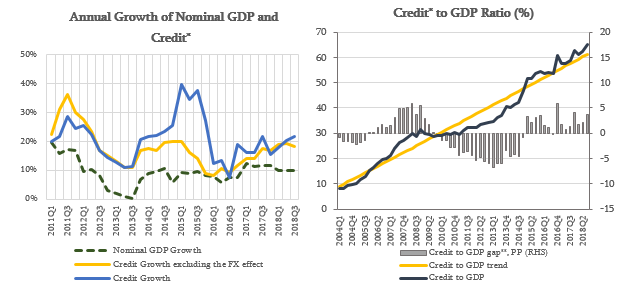

Dynamics of the financial system and the related risks have remained mainly unchanged since the previous meeting of the Financial Stability Committee (FSC). Total credit continues to rise at a high rate. In October, the annual growth rate of loans, excluding the exchange rate effect, amounted to 18%. Given the high growth rate of lending, Credit-to-GDP ratio exceeds its long run trend1, which is mainly due to the increased issuance of mortgage loans to households. Due to external risks, the growth of foreign currency loans is especially important for the financial stability. The National Bank of Georgia (NBG) recommends financial institutions to take proper account of foreign interest rate risk in loan pricing. It should be noted that the NBG pays special attention to interest rate risk in stress tests scenarios.

Source: NBG; Geostat

* Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector

** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

Financial Stability Committee of the National Bank of Georgia made a decision to leave the countercyclical buffer unchanged, at 0%. Overall credit growth indicates the need to activate countercyclical capital requirement. However, it is expected that after the enactment of the limits on Loan to Value (LTV) and Payment to Income (PTI) coefficients in January 1, 2019 will reduce lending growth to a sustainable level. The committee will monitor the impact of these macroprudential instruments on the credit portfolio growth and will decide on activating the countercyclical buffer accordingly.

Implementation of the responsible lending framework will ensure reduction of financial stability risks and will have a positive impact on the economy. This regulation will reduce excess credit burden and long run interest rates, which will contribute to economic growth. It should be noted that responsible lending regulation is the best international practice for reducing financial stability risks (for example, in the recent years, the similar regulation has been implemented in countries such as Estonia, Hungary, Sweden, Denmark, Lithuania, Czech Republic).

The National Bank of Georgia continues to monitor the country's financial stability and assess domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on February 20.

1The long run trend estimate is based on the methodology recommended by Basel Committee