Financial Stability Committee's Decision

Financial Stability Committee of the

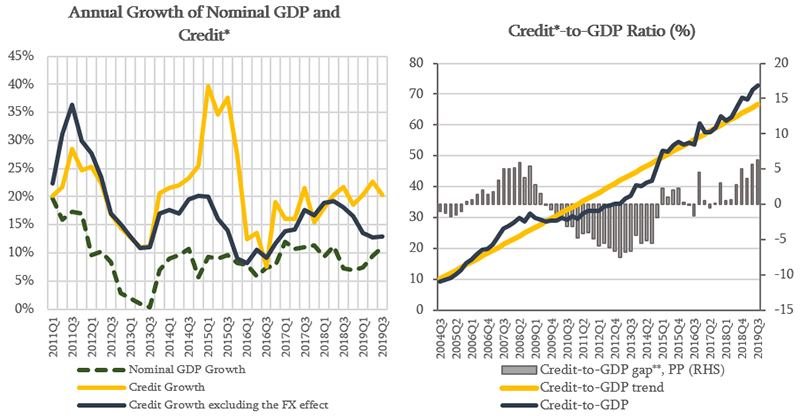

National Bank of Georgia made a decision to leave the countercyclical buffer

unchanged, at 0%. Since the regulation of responsible lending to natural

persons came into force in January 2019, the growth of loans has been following

the expected tendency. The annual growth rate of credit portfolio in October

2019 amounted to 13.9%, excluding the exchange rate effect, which is mainly due

to the growth of loans to legal entities. It should be noted that Credit-to-GDP

ratio still exceeds its long run trend, mainly due to exchange rate effect and

the excessive credit growth in past periods. According to the Committee's

assessment, the lending growth will converge to its sustainable level in the

medium term.

Source: NBG; Geostat

* Credit includes loans

directly issued by commercial banks and microfinance institutions as well as

bonds issued domestically by the non-financial sector.

** Credit-to-GDP gap is

the deviation of Credit-to-GDP ratio from its long-run trend. The trend is

estimated using HP filter in line with the Basel recommendations

Georgian financial system remains resilience against potential shocks. The banking sector is highly capitalized and liquid, and maintains high profitability indicators, while share of non-performing loans in total credit remains low. However, it should be noted that usually in the ascending credit cycle the share of non-performing loans decreases. Therefore, this indicator should not be interpreted too optimistically.

The National Bank of Georgia continues to monitor the country's financial stability and assess domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on February 26, 2020.