Financial Stability Committee's Decision

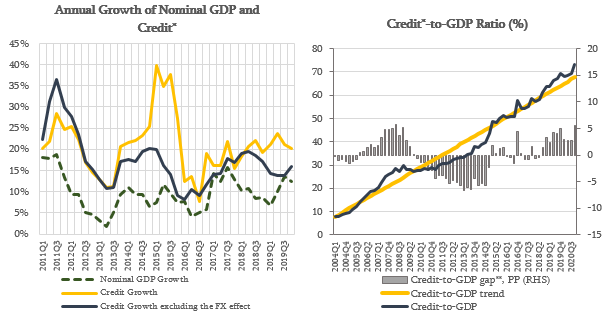

Source: NBG; Geostat

* Credit includes loans directly issued by commercial banks and microfinance institutions as well as bonds issued domestically by the non-financial sector.

** Credit-to-GDP gap is the deviation of Credit-to-GDP ratio from its long-run trend. The trend is estimated using HP filter in line with the Basel recommendations

Since the regulation of responsible lending to natural persons came into force, the credit growth has slowed down and it is now more consistent with the income growth. In January 2020, the annual growth of bank lending to households amounted to 10.8%. Mortgage loans and loans to individual entrepreneurs contributed significantly to the annual growth of household debt. In addition, lending standards have improved since the beginning of 2019. In particular, there was a reduction in the share of mortgage loans with the payment-to-income ratio (PTI) above 50%. Moreover, funds available for financing legal entities have increased. Annual growth of lending to legal entities rose to 22.9% in January 2020, which exceeds the previous year's corresponding number by 4.6 pp.

The National Bank of Georgia made a decision to simplify the regulation about lending to natural persons and strengthen its principle-based approach. The latter implies decrease in administrative burden for lenders when issuing a loan and increases their flexibility in managing risks. Among other things, the simplifications entail reducing the number of income limits determined for the payment-to-income ratio. It should be noted that the main principles of the regulation are unchanged and lending institutions shall not impose financial liability on a consumer for whom servicing the loan presents a significant financial difficulty.

The National Bank of Georgia continues monitoring the country's financial stability and assessing domestic and foreign risks. If necessary, it will use all available instruments to minimize the possible risks.

The Financial Stability Committee's next meeting will be held on May 27, 2020.